What is the MASTER BUDGET and how to use it in business planning for 2024.

Discover the power of the MASTER BUDGET and unlock its potential in driving business success.

The master budget is an essential tool for businesses of all sizes and industries. It provides a comprehensive financial plan that integrates all aspects of a company’s operations and helps guide decision-making. In this article, we explore the master budget, its advantages, and effective business utilization.

Understanding the Master Budget and Its Benefits

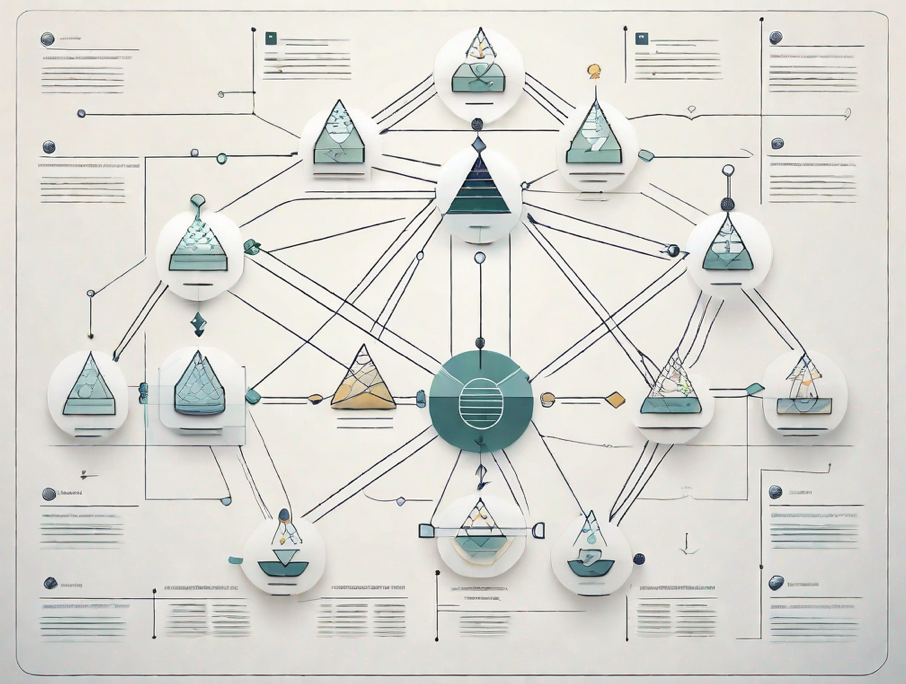

The master budget is a comprehensive financial plan that incorporates all the individual budgets of different departments within a company. It includes the operating budget, capital expenditure (CAPEX) budget, cash budget, and financing budget. By consolidating these budgets, the master budget gives a holistic view of a company’s financial performance and enables better decision-making.

The master budget serves as a roadmap for achieving a company’s financial goals, a key advantage. It sets targets for sales, expenses, and profits, and helps track progress against these targets. Effective resource allocation is also facilitated, and the identification of potential issues or areas needing improvement is assisted by it.

The operating budget, part of the master budget, projects a company’s revenues and expenses for a specific period. It includes sales forecasts, production costs, and administrative expenses. Detailed operating budgets help companies plan production, cost management, and informed decisions on pricing and resource allocation.

The capital expenditure (CAPEX) budget, another component of the master budget, focuses on the company’s investments in long-term assets. It includes projected expenses for acquiring new equipment, machinery, or property. Careful capital expenditure planning and budgeting ensure companies have resources to support growth and enhance efficiency.

The cash budget, integral to the master budget, offers a detailed analysis of a company’s cash inflows and outflows. It helps in managing cash flow, ensuring that the company has enough liquidity to meet its obligations. Cash flow forecasts help companies prepare for cash shortages or surpluses, allowing risk mitigation and opportunity maximization.

The financing budget, the final component of the master budget, focuses on the company’s financing activities. It includes projected borrowings, repayments, and interest expenses. Careful financing planning ensures companies have access to funds to support operations and growth initiatives as needed.

Sales forecasts, market trends, and industry analysis, in addition to individual budgets, are included in the master budget. This additional information helps in making more accurate financial projections and strategic decisions.

Furthermore, potential issues or areas needing improvement can be identified by companies through the master budget. By comparing actual performance against budgeted targets, companies can identify variances and take corrective actions. This process of monitoring and analyzing variances helps in improving operational efficiency, reducing costs, and maximizing profitability.

Utilizing the Master Budget to Streamline Business Financials

The master budget serves as a blueprint for managing a company’s financial resources. By analyzing the different budget components, businesses can identify areas where costs can be reduced or revenue can be increased. This enables managers to make informed decisions about resource allocation, pricing, production levels, and investment opportunities.

One of the key benefits of the master budget is its ability to provide a comprehensive view of the company’s financial health. It takes into account various factors such as sales forecasts, production costs, operating expenses, and capital expenditures. By integrating these elements into a single document, the master budget allows managers to assess the overall financial position of the business and identify potential areas of improvement.

Furthermore, the master budget aids in streamlining business operations. By aligning individual department budgets with the overall financial plan, it ensures that all departments are working towards the same goals. This coordination mitigates the risk of inefficiency or conflicts between departments, leading to a more cohesive and focused organization.

For example, let’s consider a manufacturing company that wants to increase its production output while minimizing costs. By analyzing the master budget, the management team can identify the specific areas where expenses can be reduced, such as optimizing the supply chain or renegotiating contracts with suppliers. Additionally, they can identify opportunities to increase revenue, such as exploring new market segments or launching innovative products.

Moreover, the master budget facilitates effective communication and collaboration within the organization. It provides a common framework for discussions and decision-making, ensuring that all stakeholders are on the same page. This alignment fosters a sense of unity and shared purpose, which can have a positive impact on employee morale and productivity.

Another advantage of the master budget is its ability to serve as a benchmark for performance evaluation. By comparing actual financial results to the budgeted figures, managers can assess the effectiveness of their strategies and identify areas where corrective actions are needed. This feedback loop enables continuous improvement and helps the company adapt to changing market conditions.

Components of a Master Budget and What They Mean

The master budget consists of several key components that are crucial for effective financial planning and control. Financial planning and control are essential for the success of any business. By carefully analyzing and managing the various components of a master budget, companies can make informed decisions and ensure their financial stability and growth.

Part 1. THE OPERATING BUDGET:

The operating budget includes revenue projections, production costs, and operating expenses. It provides a detailed overview of the company’s projected income and expenses, allowing managers to evaluate performance and make necessary adjustments.

Revenue projections are based on market research, historical data, and sales forecasts. By estimating future sales and pricing strategies, companies can determine their expected revenue. Production costs, on the other hand, involve expenses related to manufacturing or acquiring goods. These costs include raw materials, labor, and overhead expenses. Operating expenses encompass all other costs associated with running the business, such as rent, utilities, and marketing expenses.

Part 2. THE CAPEX BUDGET:

The CAPEX budget focuses on the company’s capital expenditures, such as investments in long-term assets or equipment. It helps businesses plan for significant investments and assess the impact on cash flow and profitability.

Capital expenditures are crucial for expanding operations, improving efficiency, and staying competitive in the market. Companies need to carefully evaluate the potential return on investment before making significant capital expenditures. This budget considers the costs of acquiring or upgrading assets, such as machinery, technology, or infrastructure. By analyzing the impact on cash flow and profitability, companies can make informed decisions regarding capital investments.

Part 3. THE CASH BUDGET:

The cash budget forecasts the company’s cash inflows and outflows, enabling managers to anticipate any potential cash shortages or surpluses. It ensures that the company has sufficient liquidity to cover its obligations and seize investment opportunities.

Cash flow management is vital for the financial health of a business. The cash budget takes into account various sources of cash inflows, such as sales revenue, investments, or loans, and predicts the timing and amount of cash outflows, including expenses, loan repayments, and dividends. By analyzing the cash budget, companies can identify potential cash shortages and take proactive measures to improve liquidity, such as adjusting payment terms with suppliers or securing additional financing.

Part 4. THE FINANCING BUDGET:

The financing budget encompasses sources of financing, such as loans, equity, or debt. It outlines the company’s plans for capital structure management, debt repayment, and interest payments. This budget helps ensure that the company’s financial structure remains sustainable and optimized for growth.

Financing plays a crucial role in supporting a company’s operations and growth. The financing budget considers the company’s capital structure, which includes the mix of equity and debt financing. It outlines the company’s plans for obtaining financing, whether through bank loans, issuing bonds, or attracting investors. Additionally, the budget includes provisions for debt repayment and interest payments, ensuring that the company can meet its financial obligations while maintaining a healthy financial structure.

By analyzing these components collectively, businesses can gain a comprehensive understanding of their financial position and plan accordingly. Financial planning and control are ongoing processes that require regular monitoring and adjustments. With a well-developed master budget, companies can make informed decisions, allocate resources effectively, and achieve their financial goals.

How to Create and Implement a Master Budget

Creating a master budget requires careful analysis and collaboration among different departments within a company. The first step is to gather historical data and analyze trends to identify patterns and potential future developments. This information serves as a foundation for accurate budget projections.

Next, individual departments and managers collaborate to develop their respective budgets. Sales forecasts, expense projections, and other relevant data are considered and integrated into the master budget.

Once the budgets are finalized, it is crucial to communicate the financial goals and targets to all stakeholders. Clear instructions and regular monitoring of performance against the budget are key to successful implementation.

It is essential to continuously evaluate and update the master budget to reflect changing market conditions, internal factors, and new opportunities. Flexibility and adaptability are vital for the budget to remain relevant and effective.

Understanding Master Budget Assumptions

Every budget is based on certain assumptions, and the master budget is no exception. Assumptions can include factors such as sales growth rates, inflation rates, costs of raw materials, or market conditions.

While assumptions provide a starting point for budgeting, it is crucial to review and validate them regularly. Market dynamics can change, and assumptions that were once accurate may no longer hold true. Adjusting assumptions based on new information ensures that the budget remains realistic and achievable.

EBITDA and Cash Flow: What’s the Difference?

While EBITDA and cash flow are related, they represent different aspects of a company’s financial performance: EBITDA focuses on operating profitability and excludes non-operating expenses, while CASH FLOW provides insights into the actual cash generated and used by the business.

The Challenges of Developing and Managing a Master Budget

Developing and managing a master budget can pose several challenges for businesses.

One common challenge is accurately forecasting sales and expenses. Market conditions may be unpredictable, and unforeseen events can impact a company’s financial performance. To mitigate this challenge, companies can utilize historical data, industry trends, and expert opinions to make informed projections.

Another challenge is ensuring departmental coordination and cooperation. In larger organizations, different departments may have conflicting goals or priorities. Regular communication, cross-departmental collaboration, and aligning individual budgets with the master budget can help overcome this challenge.

Lastly, adapting the master budget to changing circumstances can be a complex task. Businesses need to be agile and responsive, continually reassessing their financial plan and making necessary adjustments. By incorporating feedback from managers and monitoring performance against the budget, companies can address challenges and improve the effectiveness of their master budget.

Master Budget as an Effective Tool for Business Planning

The master budget plays a crucial role in business planning, providing a framework for achieving financial goals and objectives. By analyzing the different budget components, businesses can make informed decisions, optimize resource allocation, and mitigate risks.

Additionally, the master budget aids in accountability and performance evaluation. Managers can compare actual results against budgeted figures to identify areas of improvement or deviations from the plan. This analysis facilitates a culture of continuous improvement and a proactive approach to financial management.

Tips for Creating an Accurate and Effective Master Budget 💎

Creating an accurate and effective master budget requires careful planning and attention to detail. Here are some useful tips:

- Thoroughly analyze historical data and market trends to make realistic projections.

- Involve all relevant stakeholders in the budgeting process to ensure buy-in and collaboration.

- Regularly review and update assumptions based on changing circumstances.

- Monitor performance against the budget and implement corrective actions when necessary.

- Communicate financial goals and targets effectively to all departments and employees.

- Invest in robust financial systems and tools to facilitate budget creation, tracking, and analysis.

- Encourage cross-departmental collaboration and alignment with the overall financial plan.

Following these tips can enhance the accuracy and effectiveness of the master budget, enabling businesses to make better financial decisions and achieve their goals more efficiently.

What is the Operating Budget and its key elements?

The operating budget is a crucial component of the master budget. It focuses on revenue and expenses related to the day-to-day operations of the company. The key elements of an operating budget include:

- Sales budget: A projection of expected sales revenue based on historical data, market conditions, and marketing strategies.

- Production budget: An estimate of the number of units to be produced to meet sales demand.

- Direct materials budget: A forecast of the materials needed for production, including quantities and costs.

- Direct labor budget: An estimate of the labor hours required for production, including wages and related costs.

- Manufacturing overhead budget: An assessment of the indirect costs associated with production, such as utilities, maintenance, and depreciation.

- Selling and administrative expenses budget: An estimation of costs related to sales and general administration, including salaries, marketing, and office expenses.

These elements collectively provide a detailed overview of the company’s expected revenue and expenses, guiding decision-making and resource allocation.

What is CAPEX Budget and its key elements?

The CAPEX budget focuses on capital expenditures, which are significant investments in long-term assets that benefit the company beyond one year. The key elements of a CAPEX budget include:

Identification of capital investment opportunities: Businesses assess potential investments, considering factors such as ROI, payback period, and strategic importance.

Cost estimation: Companies evaluate the costs associated with capital expenditures, including acquisition, installation, maintenance, and disposal.

Financing: The CAPEX budget considers how the company plans to finance the investments, whether through internal funds or external financing sources.

Risk analysis: Businesses assess the risks associated with the proposed investments, considering factors such as market conditions, technological obsolescence, and regulatory changes.

Prioritization: Companies prioritize capital projects based on their overall strategic importance, financial viability, and anticipated returns.

The CAPEX budget helps businesses make informed decisions about long-term investments and ensures that the allocation of financial resources aligns with the company’s strategic objectives.

What is Cash Budget and its key elements?

The cash budget is an essential component of the master budget, focusing on cash inflows and outflows over a specific period. The key elements of a cash budget include:

Anticipated cash inflows: Companies estimate cash receipts from various sources, such as sales revenue, accounts receivable collections, and additional financing.

Projected cash outflows: Businesses evaluate their anticipated cash payments, including expenses, overhead costs, loan repayments, and capital expenditures.

Opening and closing cash balances: The cash budget considers the initial cash balance at the beginning of the period and the expected balance at the end of the period.

Short-term borrowing or investing: Based on the cash projections, companies assess whether they need to borrow funds or invest surplus cash temporarily.

The cash budget helps businesses manage their liquidity effectively, ensuring that they have sufficient cash flow to meet their obligations and capitalizing on investment opportunities when appropriate.

What is Financing Budget and its key elements?

The financing budget focuses on the company’s sources of financing and provides insights into its capital structure and financial obligations. The key elements of a financing budget include:

Debt financing: Businesses evaluate their borrowing needs and determine the appropriate amount and terms for loans or credit facilities.

Equity financing: Companies assess their equity requirements and consider options such as issuing new shares or seeking external investors.

Interest expense: The financing budget accounts for the interest payable on borrowed funds.

Equity dividend payments: If applicable, companies factor in dividend payments to shareholders.

Debt repayment schedule: The financing budget outlines the planned repayment schedule for loans or other forms of debt.

By assessing the sources of financing and planning for the associated costs and obligations, businesses can ensure their financial structure remains sustainable and supports their growth objectives.

Utilizing Master Budget Variance Analysis

Variance analysis is a valuable tool for assessing and understanding the deviations between actual results and the budgeted figures in the master budget. By comparing the actual performance against the budget, managers can identify the reasons for the variances and take appropriate actions. Positive variances indicate that actual results exceed the budget, while negative variances suggest actual results fall short of the budgeted figures.

Through variance analysis, businesses can pinpoint areas of success or areas requiring improvements. This analysis aids in decision-making, resource allocation, and performance evaluation, enabling managers to address issues promptly and enhance overall financial performance.

The Advantages of Establishing a Master Budget

Implementing a master budget offers a range of benefits for businesses:

- Enhanced control and planning: The master budget provides a comprehensive plan that aligns all departments and sets targets for revenue, expenses, and profitability.

- Improved decision-making: By analyzing different budget components, businesses gain insights into their financial health and make informed decisions regarding resource allocation, pricing, and investment opportunities.

- Streamlined operations: Coordinating individual department budgets within the master budget ensures all departments are working towards the same goals, enhancing efficiency and minimizing conflicts.

- Better financial management: The master budget enables effective monitoring of the company’s financial performance, ensuring that it remains on track to achieve its goals and objectives.

- Proactive risk management: By assessing the different budget components, businesses can identify potential risks and take preventative measures to mitigate them.

- Achieving financial targets: The master budget serves as a roadmap for achieving financial goals and objectives, providing a framework for measuring and evaluating performance.

IN CONCLUSION

Overall, the master budget is a powerful tool that enables businesses to effectively plan, manage, and control their financial resources, ultimately driving success and growth. The master budget plays a crucial role in the financial management of a company. It provides a comprehensive view of the company’s financial position and performance, facilitates effective resource allocation, and helps in making informed decisions. By utilizing the master budget effectively, companies can enhance their financial stability, achieve their goals, and drive long-term success. Embracing the master budget as a strategic tool can help businesses achieve long-term success and sustainable growth.

It All Starts With a FREE consultation!

Every client’s needs are unique and require varying amounts of time and attention. You can use this form to let us know what you’re looking for, and we’ll reach out to you to schedule an appointment and talk about rates for your business needs.

Please be as detailed as possible with what work is needed, what industry your business is in, and where you are located.

Our team will contact you with in 2 business days to set up the first meeting. We will make sure all your needs are taken into account when selecting the package and type of services you need.

Stay In Touch