The Best Accounting Software of 2024

Discover the best accounting software options for small businesses and startups.

Accounting software is an essential tool for small businesses and startups to manage their financial transactions and stay organized. With so many options available in the market, it can be overwhelming to choose the right one that caters to your specific needs. In this article, we will compare different accounting software options and analyze their features to help you make an informed decision.

The Best Accounting Software of 2024

Choosing the best accounting software for your small business or startup is crucial for smooth financial management. While the accounting software options are all reputable choices, the best one for you depends on your unique requirements and preferences. Consider factors such as your business size, industry, scalability, budget, and desired features when making your decision.

How To Choose the Best Accounting Software

When selecting accounting software for your small business or startup, it’s important to consider the following factors:

1. Scalability: Choose software that can grow with your business and accommodate increasing transaction volumes, users, and features.

2. Industry-specific features: If your business operates in a specific industry, opt for software that offers specialized features tailored to your industry’s unique needs.

3. User-friendliness: Consider the ease of use and interface intuitiveness to ensure that your team can quickly adapt to the software and efficiently perform their tasks.

4. Integration capabilities: If you use other software applications like CRM or e-commerce platforms, select accounting software that integrates seamlessly with them to avoid manual data entry and streamline processes.

5. Cost: Evaluate the pricing structure of the accounting software, including subscription plans, additional fees for extra features, and the potential for long-term cost savings.

6. Customer support: Look for software providers that offer reliable customer support, including phone, email, or live chat assistance, to help you resolve any issues or inquiries promptly.

By considering these factors and thoroughly evaluating the accounting software options, you can choose the best solution that aligns with your business objectives and financial management needs.

Types of Accounting Software

Accounting software can generally be categorized into three types:

Desktop accounting software: Installed directly on your computer or local server, desktop accounting software offers robust features and keeps your financial data secure. However, it lacks the mobility and collaboration capabilities of cloud-based software.

Cloud-based accounting software: Hosted on remote servers, cloud-based accounting software provides accessibility from any device with an internet connection, real-time data synchronization, and automatic backups. It offers flexibility and scalability but may require a stable internet connection.

Industry-specific accounting software: Some accounting software solutions are designed specifically for certain industries, such as retail, construction, or hospitality. These solutions often include industry-specific features and integrations.

Understanding the different types of accounting software can help you narrow down your options and choose the most suitable one for your small business or startup.

Neat accounting software and its features

Neat is a user-friendly accounting software that is specifically designed for small businesses and startups. Its features include:

Automated bookkeeping: Neat automates the process of organizing and categorizing your financial data, saving you time and reducing the risk of errors.

Invoicing: You can create and send professional-looking invoices to your clients directly through Neat.

Expense tracking: Neat allows you to track your expenses and generate expense reports effortlessly.

Inventory management: For businesses that deal with inventory, Neat provides features to track and manage your stock levels.

Neat’s automated bookkeeping feature is a game-changer for small businesses. By eliminating the need for manual data entry, it ensures that your financial records are accurate and up-to-date. With Neat, you can say goodbye to the tedious task of organizing receipts and invoices.

The software automatically extracts relevant information from your documents, such as vendor names, dates, and amounts, and categorizes them accordingly. This not only saves you time but also reduces the risk of errors that can occur during manual data entry.

In addition to automated bookkeeping, Neat also offers a powerful invoicing feature. With just a few clicks, you can create professional-looking invoices and send them directly to your clients. Neat allows you to customize your invoices with your company logo, payment terms, and other relevant details. You can even set up recurring invoices for regular clients, saving you even more time and effort.

Expense tracking is another key feature of Neat. With Neat, you can easily track your business expenses and generate detailed expense reports. The software allows you to categorize your expenses, making it easier to analyze your spending patterns and identify areas where you can cut costs. Neat also integrates with popular payment platforms, such as PayPal and Stripe, allowing you to import your transaction data seamlessly.

For businesses that deal with inventory, Neat provides a comprehensive inventory management feature. With Neat, you can track your stock levels, monitor sales, and generate reports on product performance. The software allows you to set up alerts for low stock levels, ensuring that you never run out of essential items. Neat’s inventory management feature helps you streamline your operations and make informed decisions about purchasing and stocking.

Overall, Neat is a comprehensive accounting software solution that offers all the necessary features for small businesses and startups to streamline their financial operations. Whether you’re a freelancer, a small business owner, or a startup founder, Neat can help you simplify your accounting processes, save time, and make better financial decisions.

Sage Business Cloud is a popular choice among small businesses and startups due to its extensive set of features. This accounting software provides a comprehensive solution that helps businesses manage their finances efficiently and effectively.

One of the notable features of Sage Business Cloud is its invoicing and payment functionality. With this feature, you can easily create customized invoices tailored to your business’s branding and requirements. Additionally, Sage Business Cloud allows you to accept online payments, making it convenient for your customers to settle their bills.

Another key feature of Sage Business Cloud is its bank reconciliation capability. This feature enables you to reconcile your bank statements with your financial records, ensuring that your accounts are accurate and up to date. By automatically matching transactions and identifying discrepancies, this feature saves you time and effort in maintaining your financial records.

For businesses that deal with international transactions, Sage Business Cloud offers multi-currency support. This feature allows you to handle transactions in different currencies, simplifying your accounting processes. With the ability to convert currencies and track exchange rates, you can easily manage your finances across borders.

Sage Business Cloud also provides advanced reporting capabilities. With this feature, you can generate detailed financial reports that give you insights into your business’s performance. From profit and loss statements to balance sheets and cash flow statements, these reports provide a comprehensive overview of your financial health. Armed with this information, you can make informed decisions and strategize effectively.

In conclusion, Sage Business Cloud offers a robust accounting solution that caters to the needs of small businesses and startups, especially those with complex financial requirements. With its invoicing and payments, bank reconciliation, multi-currency support, and advanced reporting features, this software empowers businesses to streamline their financial processes and make informed decisions for growth and success.

MarginEdge is an accounting software specifically designed for restaurants and food service businesses. It offers a wide range of features that can significantly benefit your establishment. Let’s take a closer look at some of its key features:

Purchase order management

One of the most important aspects of running a restaurant or food service business is managing your purchasing process. With MarginEdge, you can streamline this process by easily creating and tracking purchase orders. The software allows you to efficiently manage your vendor relationships and ensure you always have the necessary ingredients and supplies in stock.

Inventory control

Keeping track of your inventory levels is crucial for any restaurant or food service business. MarginEdge provides real-time inventory tracking, allowing you to monitor your stock levels at all times. Additionally, the software sends you low-stock alerts, ensuring that you never run out of essential ingredients. This feature helps you avoid disruptions in your operations and maintain a smooth workflow.

Recipe management

Creating and costing recipes is an essential part of managing food costs and optimizing menu pricing. MarginEdge simplifies this process by providing a comprehensive recipe management feature. You can easily create and modify recipes, track ingredient costs, and analyze the profitability of each menu item. This allows you to make informed decisions about your menu offerings and ensure that you are maximizing your profits.

Integrations

MarginEdge understands the importance of seamless data flow between different systems. That’s why the software offers integrations with popular POS systems, payroll software, and accounting platforms. By integrating MarginEdge with your existing systems, you can eliminate the need for manual data entry and reduce the risk of errors. This integration ensures that all your financial data is accurate and up-to-date, saving you time and effort.

If you own a restaurant or foodservice business, MarginEdge can significantly simplify your accounting tasks and provide valuable insights into your operations. With its powerful features and user-friendly interface, this software is a valuable tool for any foodservice establishment. Whether you’re a small cafe or a large restaurant chain, MarginEdge can help you streamline your accounting processes and make informed decisions to drive your business forward.

NetSuite is a cloud-based accounting software that offers many features suitable for small businesses and startups. Key features of NetSuite include:

Financial management: NetSuite provides tools for general ledger, accounts payable and receivable, cash management, and budgeting.

Customer relationship management (CRM): The software includes CRM functionality to manage customer interactions, sales, and marketing campaigns.

E-commerce integration: If you have an online store, NetSuite can seamlessly integrate with your e-commerce platform for efficient order processing and inventory management.

Project management: NetSuite offers project accounting features, allowing you to track project costs, budgets, and profitability.

NetSuite is a comprehensive solution for small businesses and startups that require integrated accounting and business management capabilities.

Xero is a widely popular accounting software known for its user-friendly interface and powerful features. Some notable features of Xero are:

Bank reconciliation: Xero automatically imports and categorizes your bank transactions, making it easy to reconcile your accounts.

Expense tracking: You can track and categorize expenses, attach receipts, and generate expense claims through Xero.

Payroll management: Xero includes payroll functionality, allowing you to process payroll, calculate taxes, and generate payslips.

Integration ecosystem: Xero integrates with numerous third-party applications, expanding its functionality and providing seamless data flow.

With its intuitive interface and comprehensive features, Xero is an excellent accounting software choice for small businesses and startups.

QuickBooks is one of the most widely used accounting software options for small businesses and startups. Some key features of QuickBooks include:

Accounting essentials: QuickBooks provides all the essential accounting tools, including invoicing, expense tracking, and financial reporting.

Bank feeds: You can connect your bank accounts to QuickBooks and automatically import transactions, simplifying bank reconciliation.

Inventory management: QuickBooks allows you to track inventory levels, set reorder points, and generate purchase orders.

Time tracking: If you bill clients based on hours worked, QuickBooks offers time tracking functionality to simplify invoicing and payroll calculations.

With its popularity and extensive features, QuickBooks is a reliable choice for small businesses and startups looking for efficient accounting software. In addition to its accounting essentials, bank feeds, inventory management, and time tracking features, the platform also offers a cloud-based version with Quickbooks Online and the ability to add additional users so you can use it together with your Controller and Bookkeeper.

Zoho Books is a cloud-based accounting software designed for small businesses and startups. Its features include:

Bank reconciliation: Zoho Books allows you to reconcile your bank accounts, ensuring your financial records are accurate.

Automated workflows: The software enables you to automate repetitive tasks, such as sending recurring invoices and payment reminders.

Expense tracking: You can easily track and categorize expenses, attach receipts, and generate expense reports with Zoho Books.

Client Portal: Zoho Books provides a portal where customers can view and pay their invoices online.

Zoho Books is a cost-effective accounting solution that offers essential features and seamless integration with other Zoho business applications.

Freshbooks accounting software and its features

FreshBooks is a cloud-based accounting software that is particularly popular among freelancers and service-based businesses. Some of its features include:

Time tracking: With FreshBooks, you can easily track and invoice your billable hours, making it ideal for businesses that charge based on time.

Client management: The software allows you to store client information, track communication history, and send professional-looking estimates and proposals.

Expense management: FreshBooks provides features for tracking expenses, including mileage tracking and receipt scanning.

Payment processing: You can accept online payments through FreshBooks, speeding up the payment collection process.

If you are a freelancer or own a service-based business, FreshBooks offers a simple and intuitive accounting solution tailored to your needs.

Kashoo is a cloud-based accounting software that caters to small businesses and startups. Its notable features include:

Double-entry accounting: Kashoo follows the double-entry accounting method, ensuring accurate and reliable financial records.

Invoicing: You can easily create professional invoices and track their status with Kashoo.

Budgeting: The software provides budgeting tools to help you plan and track your finances.

Mobile app: Kashoo offers a mobile app, allowing you to manage your accounting tasks on the go.

Kashoo is a user-friendly accounting software solution that suits the needs of small businesses and startups, particularly those looking for mobile accessibility.

Analyzing the Features of Accounting Software for Small Businesses and Startups

When analyzing the features of accounting software for small businesses and startups, consider the following aspects:

Basic accounting features: Ensure that the software covers essential accounting tasks, such as invoicing, expense tracking, bank reconciliation, and financial reporting.

Automation and efficiency: Look for features that automate repetitive tasks, minimize manual data entry, and streamline your workflow to save time and reduce errors.

Scalability: Consider whether the software can accommodate your business’s growth and handle increased transaction volumes and data storage.

Integration capabilities: Assess whether the software can integrate with other systems or platforms you use, such as CRM, e-commerce, or payroll software, to streamline data flow and avoid duplicates.

Security and data privacy: Check the software’s security measures, data encryption, backups, and compliance with relevant privacy regulations to protect your financial information.

User support and training: Ensure that the software provider offers sufficient customer support, training resources, and user documentation to assist you in utilizing the software effectively.

Analyzing these features will help you identify the accounting software that caters to your specific needs and provides the necessary tools to manage your financial operations efficiently.

Examining the Top Accounting Software Packages for Small Businesses and Startups

Now, let’s examine the top accounting software packages mentioned earlier in this article and how they compare:

Neat accounting software: Neat offers automated bookkeeping, invoicing, expense tracking, and inventory management. It is user-friendly and suits the needs of small businesses and startups.

Sage Business Cloud accounting software: Sage Business Cloud provides extensive features, including invoicing, bank reconciliation, multi-currency support, and advanced reporting. It is suitable for businesses with complex financial requirements.

MarginEdge accounting software: MarginEdge specializes in the restaurant and food service industry, offering purchase order management, inventory control, recipe management, and integrations with POS systems.

NetSuite accounting software: NetSuite is a comprehensive cloud-based solution that handles financial management, CRM, e-commerce integration, and project management.

Xero accounting software: Xero offers bank reconciliation, expense tracking, payroll management, and various integrations. It is known for its intuitive interface.

QuickBooks accounting software: QuickBooks provides accounting essentials, bank feeds, inventory management, and time-tracking features. It is widely used and trusted by small businesses and startups.

Zoho Books accounting software: Zoho Books offers bank reconciliation, automated workflows, expense tracking, and a client portal. It is cost-effective and integrates with other Zoho applications.

FreshBooks accounting software: FreshBooks is designed for freelancers and service-based businesses, offering time tracking, client management, expense management, and payment processing.

Kashoo accounting software: Kashoo follows the double-entry accounting method and provides features such as invoicing, budgeting, and mobile accessibility.

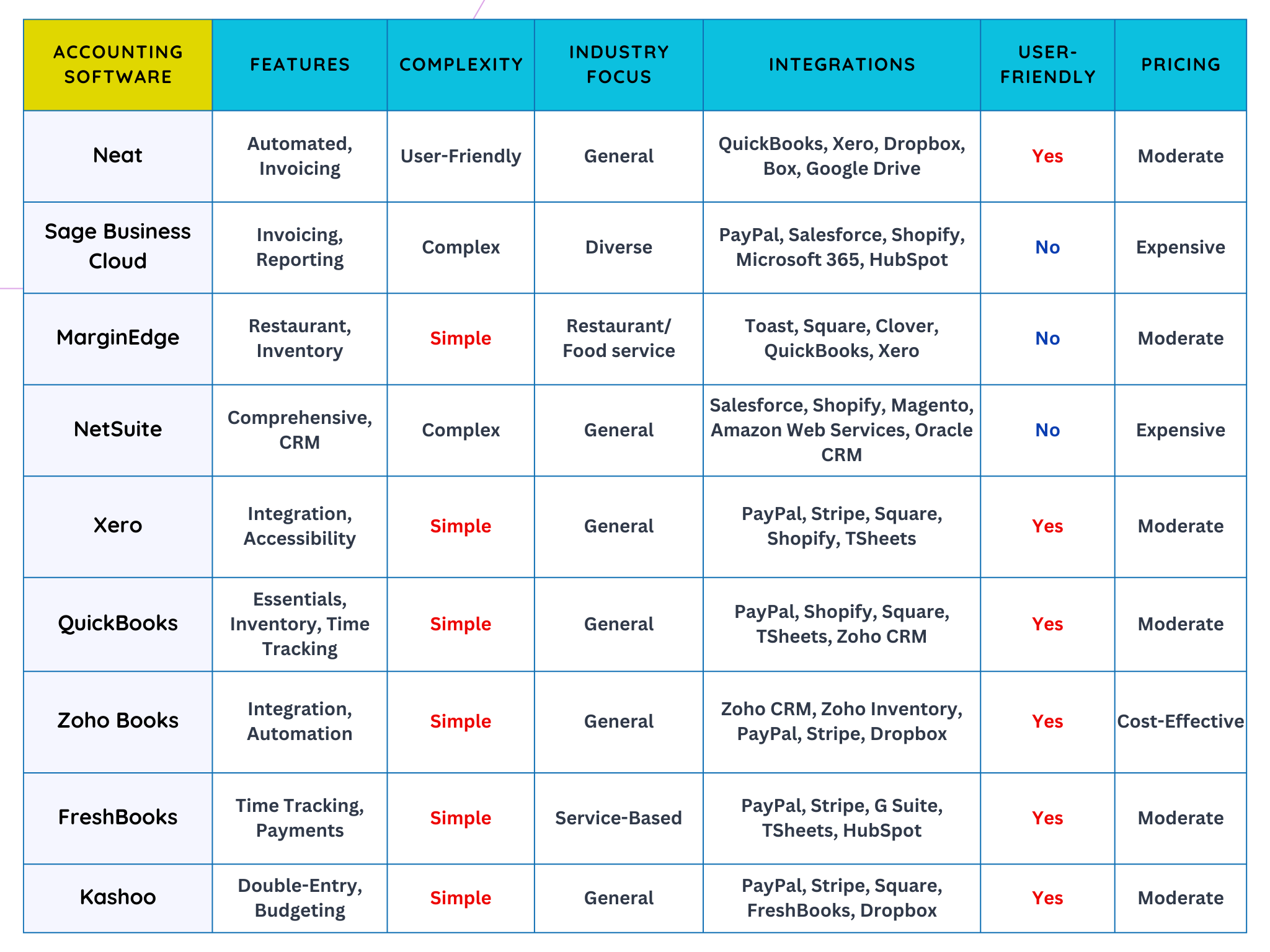

Here’s a comparison table to help you make a decision:

IN CONCLUSION

Overall, there is a wide range of accounting software options available for small businesses and startups. Each accounting software package has its own strengths and focuses, so consider your specific requirements and compare the features to find the best fit for your small business or startup. By carefully evaluating your needs, analyzing the features, and considering factors such as scalability, industry-specific requirements, user-friendliness, and cost, you can choose the best accounting software that empowers you to effectively manage your finances, streamline processes, and drive the success of your business.

It All Starts With a FREE consultation!

Every client’s needs are unique and require varying amounts of time and attention. You can use this form to let us know what you’re looking for, and we’ll reach out to you to schedule an appointment and talk about rates for your business needs.

Please be as detailed as possible with what work is needed, what industry your business is in, and where you are located.

Our team will contact you with in 2 business days to set up the first meeting. We will make sure all your needs are taken into account when selecting the package and type of services you need.

Stay In Touch