The banking sector is a critical component of modern economies, serving as a cornerstone of the financial infrastructure that offers various financial services to individuals and businesses alike. However, this industry is not immune to risk, and enterprises must stay vigilant against potential threats that can jeopardize their integrity and stability. Credit risk, market risk, operational risk, and cyber threats are significant concerns for banks that require robust risk management frameworks.

Compliance risk is another key consideration for the banking sector, arising from violations of laws, regulations, and internal policies, resulting in financial penalties, legal action, and reputational damage. This risk can be managed through a comprehensive compliance program that includes policies and procedures, training, monitoring, and reporting. Risk management software is imperative in the banking sector and requires sound risk management for various reasons. It safeguards customer trust, provides a competitive advantage, reduces capital requirements, and helps avoid surprises in daily work through proactive risk management.

The notion that banking is primarily centered around trust is upheld by our client, a prominent bank in the European region that is considered a system-critical institution in Northern Europe and globally. They assert that the simplest way to establish and sustain trust is by upholding its fundamental principles, which include taking responsibility, acting ethically, and fulfilling commitments. Periodically, they initiate compliance-oriented instructional initiatives to provide their employees with pedagogical tools to enhance their awareness of the most recent developments in the compliance field.

In this blog, we will discuss how we helped the client enhance its web-based compliance training program, which, when rolled out to 9000 employees, resulted in a 97% completion rate on time against a target of 93%. Furthermore, that received a very good Net Promoter Score (NPS) and a high impact score.

Stand-Out Features of the Training Program

Creating a Risk-Aware Culture: A Comprehensive and Engaging Online Training Program

The European bank knew that any risk could potentially threaten its finances and reputation in the market. Their employees must be aware of these risks and their potential outcomes and manage them accordingly. Considering the various business objectives and conditions, they searched for a resolution, ultimately creating the online training program called ‘We Are All Risk Managers.‘ They wanted all employees to believe in this mantra to navigate the risks.

Moreover, when making a risky decision, employees from the banking industry should ask themselves three fundamental questions:

- Can I do it?

- Should I do it?

- What are the risks?

They must evaluate whether they possess the necessary skills and abilities, consider whether it’s advisable to proceed and identify and evaluate the potential risks involved. Answering these questions can help employees make informed decisions based on a comprehensive risk assessment.

We proposed implementing a scenario-oriented approach to eLearning to emphasize the importance of employees asking these thoughtful questions.

Here are the specifics of how we developed an interactive and engaging web-based training (WBT):

Target Audience

The 20-minute training targets new and existing managers at all bank locations. Specific learning, behavior, and business goals were established to ensure its far-reaching impact.

Developing a Habit of Responding to Risks

By instilling the belief that a predetermined procedure must be followed in any situation, learners can respond appropriately to risks. To facilitate this, we created an engaging, interactive course that uses scenario-based quizzes and feedback to encourage learners to apply the concepts learned in real-world situations.

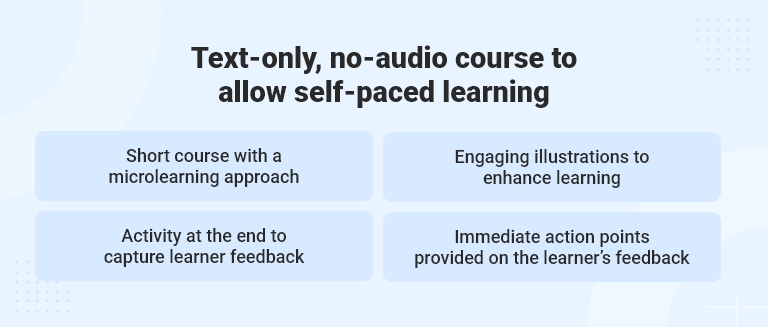

Learner-Centered Microlearning for Effective Training

Our proposal involved implementing a learner-centered microlearning strategy based on research indicating that short bursts of information lasting less than 15 minutes are more effective than longer-form training, such as 30-45-minute eLearning courses. This approach is particularly effective when integrated into job-specific contexts.

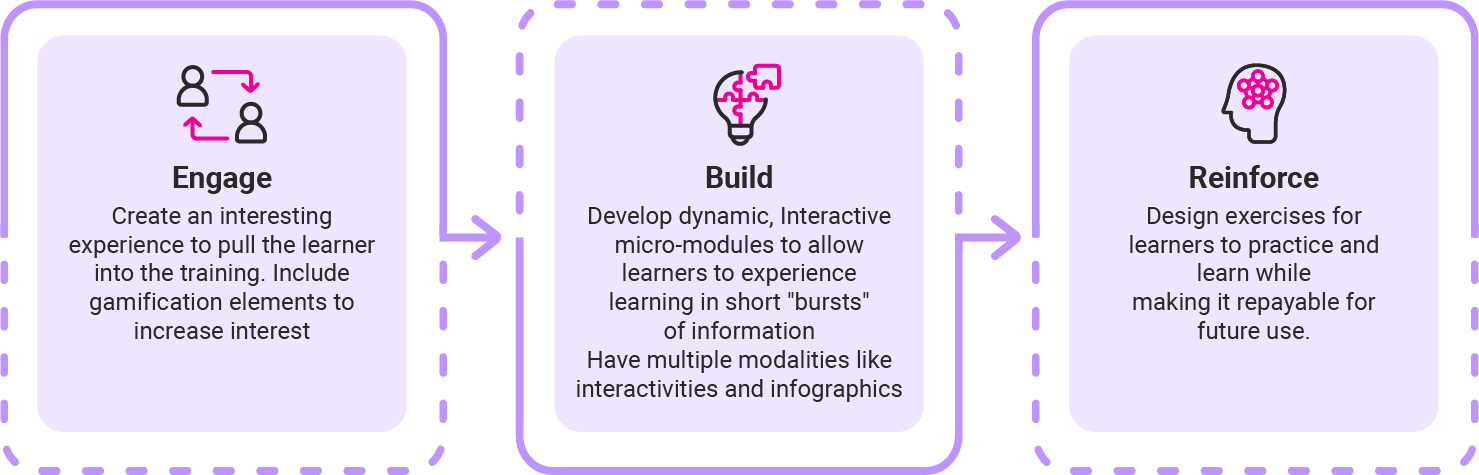

Engage, Build, and Reinforce Learning Strategy

We developed a strategy that promotes learner engagement and work efficiency by combining various methodologies, including media-rich web-based training (WBT), infographics, and short animations. The “Engage, Build, and Reinforce” learning strategy was identified as the most effective for the European bank and had the potential to enhance learner engagement.

Modalities Used to Design an Engaging Awareness-Level Course

The awareness-level course was designed using a combination of presentation strategies, including:

- High-impact key ideas conveyed through typography and images on static screens.

- Interactive screens offer various static and interactive options to engage the learner and allow them to delve deeper into the concepts. Examples include click and reveal, tab, accordion, and drag-and-drop activities.

- Downloadable infographics visually representing key concepts engagingly and interestingly.

Features Added to Enhance Learner Engagement

- Modular with microlearning: A 20-minute course divided into 5 topics of 3-6 minutes each with linear navigation.

- Scenario-based approach: Provided leaders with scenarios as a bridge from theory to practice, a first-hand experience of the learner’s work life.

- Interactive learning: Encouraged active participation through screen elements.

- Illustrations: Used modern illustrations for effective content delivery.

- Intuitive UI elements: The UI design elements were crafted to create a neat and uncluttered screen.

Capturing Learner Feedback

The bank wanted to collect feedback from learners after the course to improve training, ensure compliance, and offer immediate guidance. Learners could express their agreement or disagreement with statements about their understanding of the content, role, and responsibilities. Text entry boxes enabled them to record their thoughts, and learners were given resources and guidance based on their level of comprehension.

Future Outlook

The designed course resonated with learners because of it:

- Enhanced their understanding of risk management.

- Emphasized the significance of risk management for both compliance and business objectives.

- Highlighted the learner’s crucial role in contributing to the bank’s success, regardless of their position in the value chain.

As the compliance course deals with risk and compliance, it will require updating every two years, and learners will need to demonstrate their understanding each time. This ensures that the course remains current and effective.

Infopro Learning focuses on solving modern-day banking business challenges with custom learning solutions, enabling full-scale workforce transformation. Connect with us.