Overview: Learning Tech Industry M&A Investment Trends, 2021-2022

Miss a year and you miss a lot – especially when it comes to recent learning tech industry M&A and other investment moves! It seems like only yesterday when, at the start of 2021, I predicted that mergers and acquisitions would intensify. I knew strong investor interest would continue to drive momentum. But no one could have predicted the epic M&A tsunami we’ve seen since then.

Looking back at the dozens of deals that closed over the past 16 months confirms what many of us already know. Although the pandemic helped fuel historic funding levels in 2020, with plenty of money still available to go around last year, investment continued to skyrocket.

In fact, 2021 totals are estimated between $20-$50 billion, globally, according to sources like BrightEye Ventures, Reach Capital, Metariverse and others. No corner of the learning tech industry remained untouched. As a result, the market landscape has permanently changed in profound ways.

Show Me the Money

Want to decide for yourself just how much our sphere is changing? Then I invite you to review the massive list of news clips we’ve compiled below, in 9 key categories:

- RESKILLING, UPSKILLING & CONTINUING EDUCATION

- LANGUAGE SKILLS SOLUTIONS

- WORKFORCE LEARNING & TALENT TECH

- CUSTOMER EDUCATION & PRODUCT ADOPTION SOFTWARE

- SALES TRAINING & CUSTOMER CARE TOOLS

- LIFE SCIENCES, WORK SAFETY & HEALTH EDUCATION

- KNOWLEDGE SHARING & COMMUNITY TOOLS

- REMOTE WORK & ONLINE EVENTS MANAGEMENT

- OTHER LEARNING TECH INNOVATORS

Want more detailed insights about today’s rapidly changing learning tech industry? You’ll be interested in our 2022 Learning Systems Market Report. Based on in-depth analysis we conduct when vetting vendors for our annual Talented Learning Systems Awards, this publication will be available later this summer. To receive advance notification about this report and to lock in an early-bird discount, enter your email here:

Top Movers and Shakers

Not surprisingly, some of the best-known names in learning technology have been most active on the investment scene – each spearheading multiple transactions in recent years. For example:

- Two years ago, when Cornerstone acquired Saba Software, I weighed in on the implications.

- Then last October, CSOD went private in a deal with Clearlake Capital Group estimated at $5.2 billion.

- Soon after, the company launched its next-generation Xplor platform.

- And most recently, two years after the Saba news, CSOD announced plans in January to acquire another leading learning tech provider, EdCast.

Of course, CSOD hasn’t been the only industry giant that has been flexing its growth muscles. For instance, these two companies also made bold moves:

Learning Technologies Group (LTG)

This British learning technology holding company took advantage of global market disruption to continue its portfolio expansion throughout 2021:

- In January, LTG acquired the performance management platform, Reflektive.

- Only one month later, LTG acquired corporate learning platform, Bridge LMS, from Instructure, marking the academic platform provider’s return to its K-12/higher education roots.

- Also that month, LTG acquired PDT Global, a leading provider of consulting and content for diversity and inclusion training.

- Then last July, LTG moved to acquire learning consulting, content and managed services provider, GP Strategies.

This continuing education provider for accounting, finance and healthcare professionals has scaled its offerings through a series of strategic acquisitions:

- First, the company acquired CME Outfitters in Jul 2020 and The Income Tax School in Dec 2020.

- Next came The Rx Consultant in March of 2021, and Creative Educational Concepts, a continuing education provider for clinical workers, in May.

- In August, KnowFully purchased IA MED, a specialist in EMS Training and recertification, and in November, ChiroCredit followed.

- Now in 2022, the buying spree continues with the acquisition of American Fitness Professionals (AFPA) and Psychotherapy.net early in March, and MasterCPE later that month.

For a more complete understanding of noteworthy deals involving other learning technology industry players, check the collection of news clips below…

Learning Tech Industry Investment Highlights 2021-2022

RESKILLING, UPSKILLING & CONTINUING EDUCATION

- Jan 2021: WhiteHat rebranded as Multiverse and raised $44 million to develop tech apprenticeships in the U.S.

- Feb 2021: Technology skills development platform, Codeacademy, raised $40 million in Series D funding to accelerate its DTC and B2B business. And then in December, the company was acquired by corporate digital learning solutions provider, Skillsoft, for $525 million.

- Feb 2021: Tech industry paid apprenticeship intermediary, Bitwise, raised $50 million to continue its mission to reskill people from underserved segments of the nation. This brought total funding to $100 million.

- Mar 2021: Coursera filed for an initial public offering, which was completed in June.

- Mar 2021: AI-powered reskilling/upskilling platform, retrain.ai, closed $13 million in Series A funding, followed in August by an additional $7 million to expand in the U.S.

- Mar 2021: NYU professor Scott Galloway’s Section4 online upskilling platform raised $30 million in venture capital to democratize professional business education.

- Mar 2021: Southern New Hampshire University (SNHU) acquired online technology education provider, Kenzie Academy, to give SNHU students access to short-term and job-focused microcredentials.

- Apr 2021: Upskilling platform, Degreed, raised $153 in Series D funding from investors who valued the company at more than $1.4 billion.

- Apr 2021: CerifFi, a leader in financial services industry education, expanded into insurance training by acquiring CPMI Professional Development.

- Apr 2021: Thinkific, a leading online course platform for entrepreneurial subject matter experts, announced its initial public offering.

- Apr 2021: Workforce technology skills development provider, Pluralsight, went private after being purchased by Vista Equity Partners. Soon afterward in July, Pluralsight acquired cloud skills development platform, A Cloud Guru.

- Jun 2021: Education technology company, 2U, bought the open-access online course platform, edX, for $800 million.

- Jul 2021: Blackstone acquired a majority stake in online data science bootcamp, Simplilearn, for $250 million.

- Jul 2021: QA, the UK’s top technology skills development company, acquired digital marketing skills training provider, Circus Street.

- Jul 2021: LearnWorlds, an all-in-one platform for creating and selling online courses, secured $32 million in growth funding.

- Jul 2021: As part of a $100 million 2021 acquisition plan to expand its digital skills development offerings, India’s Veranda Learning Solutions acquired live online upskilling pioneer, Edureka.

- Aug 2021: Association LMS provider, WBT Systems, was acquired by engagement management system vendor, Advanced Solutions International.

- Aug 2021: Eagle Point Software, an online learning platform for architecture, engineering and construction professionals, acquired KnowedgeSmart, a company that provides skills gap analysis and benchmarking services to AEC firms.

- Sep 2021: Online course provider, Udemy, acquired CorpU to expand immersive leadership development capabilities. Then only one month later, Udemy filed for its initial public offering, which targeted a $4 billion valuation, but fell short at $3.7 billion.

- Sep 2021: Digital assessment and proctoring platform provider, Inspera, received a significant growth capital investment from CGE Partners.

- Oct 2021: Freelancing marketplace Fiverr acquired CreativeLive, an online learning platform that educates design professionals in creative and entrepreneurial skills.

- Oct 2021: Hone, a live online skills development platform, raised $16 million in Series A funding to build its go-to-market team.

- Oct 2021: Learning outsourcing provider, NIIT Services, acquired RPS Consulting, a leading provider of professional training focused on emerging technologies.

- Dec 2021: Upskilling coaching and learning platform provider, GoCoach, raised $3.5 in seed funding.

- Dec 2021: Executive development and search firm, Felix Global, acquired executive assessment, transition and career planning company, Shields Meneley.

- Dec 2021: Student employment readiness solution provider, Symplicity, acquired post-secondary experiential learning company, Orbis Communications.

- Dec 2021: Lepaya, a power skills professional training provider, received $40 million in Series B funding to expand its hybrid learning offerings.

- Dec 2021: Esme Learning Solutions, a leader in immersive online professional development, closed $15 million in additional equity to expand its business. Several months later in February, Esme raised another $15 million, for a total of $38.5 million in funding.

- Jan 2022: Learning industry leader, Pearson, acquired digital credentialing leader, Credly.

- Jan 2022: Financial industry professional education provider, Training The Street, acquired AMT Training to expand its footprint.

- Jan 2022: Web 3 “learn-to-earn” platform, Proof of Learn, raised $15 million in funding to launch its first educational program by mid-year.

- Jan 2022: Spanish cloud-based learning solutions company, Netex, bought UK online course provider, Virtual College.

- Feb 2022: Fast-growing cybersecurity and digital skills training provider, ThriveDX (formerly HackerU), received an additional $95 million in funding to accelerate the company’s offerings.

- Mar 2022: All-in-one live knowledge content creation platform vendor, Disco, closed $15 million in a Series A round.

- Mar 2022: Professional education provider, Colibri, expanded its capabilities with the acquisition of Becker Professional Education and OnCourse Learning.

- Mar 2022: Engineering career development platform company, Reforge, closed a $60 million Series B growth round.

- Apr 2022: Technology skills development provider, SkillStorm, acquired hire-train-deploy company, Talent Path.

- Apr 2022: HelpSystems acquired phishing simulation and security awareness training firm, Terranova Security.

- Apr 2022: Enterprise virtual reality platform provider, Strivr, closed $35 million in additional Series B funding from Accenture, Workday Ventures and others to expand its immersive upskilling and reskilling solutions.

- Apr 2022: Skills-to-jobs marketplace, Unmudl, closed $1.275 million in seed funding to expand its training and certification reach among community colleges and employers.

LANGUAGE SKILLS SOLUTIONS

- Jan 2021: Language upskilling platform, EnGen, received first-round funding from multiple investors, so the organization can help more U.S. immigrants succeed as new Americans.

- Feb 2021: AI-powered mobile app, ELSA (English Language Speech Assistant) raised $15 million in new capital to expand in Latin America.

- Mar 2021: Personalized education product provider, IXL Learning, acquired Rosetta Stone, the leader in technology-based language education. This was the second time Rosetta Stone was acquired in less than a year, with the previous sale to Cambium Learning Group in Aug 2020.

- Jul 2021: The world’s most popular mobile language development app, Duolingo, went public, with a total valuation of $4.7 billion.

- Nov 2021: Leading language and technology services provider, TransPerfect acquired executive language training firm, Transfer Group.

- Apr 2022: Several months after acquiring digital credentialing vendor, Credly in January 2022, Pearson acquired global online language learning platform, Mondly.

WORKFORCE LEARNING & TALENT TECH

- Jan 2021: Kallidus, acquired onboarding software company, Sapling, to further enhance its talent management and learning platform.

- Jan 2021: Sana Labs received $18 million Series A funding to expand the reach of its AI-driven workforce learning personalization and engagement tools.

- Jan 2021: Adaptive microlearning tools provider, Mindmarker, closed expansion capital funding to further develop its technology.

- Jan 2021: Learn to Win raised $4 million in seed funding to launch its mobile-first active learning platform for high-performance teams.

- Jan 2021: Restaurant operations platform vendor, CrunchTime!, acquired hospitality industry learning and development solutions provider, DiscoverLink.

- Jan 2021: AI-based learning suite provider, Docebo, closed a post-IPO secondary offering valued at $115 million, followed in September by another round in a bought deal with gross proceeds of $128.8 million. Then in January of this year, Docebo acquired Skillslive, an Australian educational consultancy to expand its presence in the Asia Pacific region.

- Feb 2021: Praxis Labs launched its VR-based diversity and inclusion learning platform in conjunction with seed funding from a team of venture capital firms.

- Mar 2021: LMS provider, Axonify, acquired digital learning platform MLevel to double down on its mobile-first frontline training and communication solution strategy.

- Mar 2021: Centrical (formerly GamEffective) closed $32 million in expansion-round funding for its employee success platform that leverages personalization, microlearning, real-time performance management and adaptive coaching tools.

- Mar 2021: CommPartners was acquired by Symphony Technology Group, a private equity firm focused on software and tech-enabled services. STG’s strategy was to combine CommPartners technology with solutions from 3 other vendors acquired in 2020 – CadmiumCD, EthosCE and Warpwire – to create a unified learning and events platform.

- Mar 2021: eLearning Brothers (now ELB) continued its expansion by acquiring The Game Agency. Then, early in 2022, the company closed an additional $54 million to fund the acquisition of Origin Learning and video-based coaching and practice platform, Rehearsal. And in April, ELB acquired corporate training services provider, CoreAxis.

- Apr 2021: Private equity partnership, Silversmith Capital, sold Absorb Software to another private equity firm, Welsh, Carson, Anderson & Stowe.

- Apr 2021: Global learning platform company, Kahoot!, acquired learning engagement app provider, Motimate.

- Apr 2021: Gamified simulation training platform provider, Attensi received a $26 million funding round for business expansion.

- Apr 2021: Leadership training provider, FranklinCovey, acquired social learning and coaching platform startup, Strive.

- Jun 2021: CYPHER LEARNING, an LMS provider serving both enterprise and educational markets raised $40 million in growth equity.

- Jun 2021: In what was positioned as the largest deal in India’s corporate learning space, solutions provider MRCC Group acquired digital learning platform and content provider, G-Cube.

- Jul 2021: Online learning development platform provider, Articulate, raised $1.5 billion in one of the largest series A funding rounds in U.S. history.

- Jul 2021: Online training innovator, OpenSesame, received a $50 million investment to accelerate global expansion.

- Jul 2021: Digital learning technology company, Valamis, acquired career mobility and organizational performance technology provider, The Working Manager.

- Jul 2021: Enterprise learning and knowledge platform provider, Fuse Universal, acquired performance support platform, PowerGuides, and unveiled a strategic alliance with enterprise knowledge search specialists, PureInsights.

- Jul 2021: Go1, one of the world’s largest corporate education content hubs, raised $200 million in Series D funding to further expand in existing markets. And then in April 2022, Go1 acquired multinational elearning content and platform provider, Coorpacademy.

- Sep 2021: Pluribus Technologies acquired online learning content development firm, Pathways Training and eLearning.

- Sep 2021: Workforce LX/LMS platform provider myskillcamp secured a $13 million investment to expand its European market reach.

- Oct 2021: Collaborative learning tech vendor, 360Learning, raised $200 million in funding from multiple investment firms to advance its position in what HR Tech luminary, Josh Bersin, calls the “corporate learning creator platform” space.

- Jan 2022: Cengage Group acquired Infosec to expand its workforce education capabilities with cybersecurity training.

- Jan 2022: Collaborative learning platform provider, 360Learning, acquired the UK’s leading learning management system, Looop, in a $200 million deal.

- Jan 2022: Real-time workforce engagement, development and performance management platform, Lattice, raised an additional $175 million, bringing the company’s total valuation to $3 billion.

- Feb 2022: Spatial computing company, Tailspin, closed a $20 million Series C round to expand its talent development and skills mobility offering.

- Feb 2022: Learning amplification platform, Continu, secured $13.5 million Series A funding to scale its platform globally.

- Mar 2022: All-in-one learning platform, WorkRamp, raised $40 million in Series C funding, bringing total investment to $67 million.

- Mar 2022: Corporate talent academy platform provider, Learn In secured $10 million in Series A funds to expand its employee skills development mission.

- May 2022: Blended learning platform vendor, Rise Up, raised $30 million to further scale the company’s European growth.

CUSTOMER EDUCATION & PRODUCT ADOPTION SOFTWARE

- Jan 2021: In-app onboarding, product adoption and knowledge sharing platform, Spekit, closed $12.2 million Series A funding. And then early in 2022, the company raised an additional $45 million in expansion funds.

- Mar 2021: Only 4 months after receiving a $14.4 million round of expansion funding, customer-focused product knowledge coordination platform, Zoomin, landed a $52 million Series C round from multiple equity partners.

- Aug 2021: Digital Adoption Solutions provider, Whatfix, acquired Nittio Learn LMS, to help make digital product education more personalized and adaptive.

SALES TRAINING & CUSTOMER CARE TOOLS

- Jan 2021: Xerox enhanced its customer service technology offerings by acquiring CareAR, which makes expertise available in real-time through interactive visual AR tools.

- Jan 2021: SalesLoft, the leading sales engagement platform, raised $100 million to continue its rapid business growth. This round brought total funding to $245 million.

- Feb 2021: Sales enablement platform, Highspot, raised $200 million in growth funding to further expand its market reach in response to surging demand.

- Apr 2021: Pathlight, a real-time performance management platform for customer-facing teams, raised $25 million to continue expanding its growth. And then in January 2022, the company closed another round at $248 million, bringing total equity funding to $648 million.

- Aug 2021: Leading sales enablement platform, Seismic, raised $170 million in Series G funding and also purchased team learning platform provider Lessonly.

- Aug 2021: Sales enablement tools provider, Bigtincan, bought sales readiness platform, Brainshark.

- Aug 2021: MindTickle, a leader in sales readiness technology, raised $100 million in Series E funding, for a total of $281 million in equity.

- Oct 2021: Sales coaching and gamification provider, Ambition, received a “significant” round of growth financing to accelerate the company’s offerings for hybrid work environments.

LIFE SCIENCES, WORK SAFETY & HEALTH EDUCATION

- Jan 2021: mPulse Mobile, a leader in conversational AI solutions for the healthcare industry, acquired The Big Know to add streaming consumer health education experiences to its offerings. (Jan 2021). Then in Jan 2022, mPulse Mobile acquired HealthCrowd, a health engagement company that serves the Medicaid market.

- Mar 2021: Therapeutic Research Center, a leading provider of drug therapy and medication management education for healthcare clinicians, acquired healthcare continuing education solution provider, NetCE.

- Jun 2021: Healthcare education platform provider, TrueLearn, expanded its footprint and functionality by acquiring audiovisual learning tool developer, Picmonic.

- Nov 2021: Environmental health and safety instruction provider, HSI, purchased professional microlearning pioneer, Blue Ocean Brain.

- Dec 2021: Lecturio, a medical education provider, raised $45 million in growth capital to expand its global footprint.

- Dec 2021: Healthcare industry skills development company, HealthStream, acquired SaaS-based continuing medical education management and delivery provider, Rievent Technologies.

- Jan 2022: headversity completed $10 million in funding to grow its employee mental health and safety skills platform.

- Apr 2022: Workplace health and safety training specialist, 360training, acquired HIPPA Exams to kickstart its entry into the healthcare sector with 29 new courses.

KNOWLEDGE SHARING & COMMUNITY SOLUTIONS

- Jan 2021: AI-driven Knowledge-as-a-Service company, Lynk, received $24 million in second-round funding to advance the product roadmap and expand U.S. operations.

- May 2021: Community engagement platform, Higher Logic, acquired competitor, Vanilla Forums.

- Sep 2021: Digital coaching platform, CoachHub, secured $80 million in Series B2 funding, for a total of $110 million.

- Jan 2022: Workplace mentorship program management vendor, Together, raised $5 million in funding to grow its business.

- Feb 2022: Profi raises $6 million seed round to help trainers, coaches and other professional services providers work and collaborate more effectively with corporate clients.

REMOTE WORK & ONLINE EVENTS MANAGEMENT

- Jan 2021: Virtual event and webinar platform provider, ON24, announced its initial public offering.

- Mar 2021: KUDO, a cloud-based video conferencing platform with real-time multilingual interpretation capabilities, closed $21 million in Series A funding to develop its Language-as-a-Service business.

- Apr 2021: All-in-one deskless employee app, Connecteam, closed a $37 million expansion capital round from multiple investment firms.

- May 2021 Open work operating system provider, Monday.com, filed for an initial public offering, which was completed in June.

- Jun 2021: Virtual events platform, Hopin, raised $400 million in March. Subsequently, LinkedIn joined its roster of investors.

- Jul 2021: YOOBIC, an all-in-one digital work and learning platform for frontline teams, raised $50 million in Series C funding, for total equity of $80 million.

- Aug 2021: WorkJam, an all-in-one digital workplace app for frontline employees, received $35 million in growth financing.

- Jan 2022: Microlearning-focused EduMe raised $20 million to expand its deskless workforce training solution.

- Mar 2022: Following a $37 million funding round in April 2021, Connecteam raised $120 million in Series C funding to expand its deskless workforce enablement solution.

OTHER LEARNING TECH INNOVATORS

- Mar 2021: Text-based learning messaging platform, Arist, expanded seed funding to $3.9 million.

- Apr 2021: AI video generation platform, Synthesia, received $12.5 million in first-round funding led by FirstMark.

- Apr 2021: Publishing industry solutions provider, Ingram Content Group sold educational technology developer, VitalSource Technologies, to private equity firm, Francisco Partners.

- May 2021: AR-powered visual guidance platform, SightCall, received $42 million in capital funding to further develop its innovative enterprise support solution.

- May 2021: Vimeo, the world’s leading all-in-one video software solution, began trading on the Nasdaq as a separate, public company, after spinning off from IAC. And later in 2021, Vimeo acquired two technology providers to advance its position in the enterprise space: Wibbitz, an automated short-form video creation suite and WIREWAX, a powerful interactive TV tool.

- Jun 2021: Immersive learning technology startup, Motive.io, received seed funding to further develop its enterprise VR training solution.

- Sep 2021: Managed hosting services provider, Liquid Web, acquired the WordPress learning platform provider, LearnDash.

- Sep 2021: Interactive content development platform, Tiled, closed $13.7 million in Series A funding.

- Oct 2021: Higher education solutions provider, Anthology, completed its merger with global edtech software company, Blackboard, to create a comprehensive solution for learner and institutional success.

- Oct 2021: “Snapchat for work” company, Volley, received a $5.5 million seed investment for its asynchronous messaging app.

- Oct 2021: Leading educational content provider, Wiley, continued its ongoing commitment to strategic acquisitions with the purchase of three companies – editorial operations company, J&J Editorial, as well as Knowledge Unlatched, an innovator in online open access, and eJournalPress, a scholarly publishing software and services provider.

- Nov 2021: Digital learning ecosystem leader, Instructure, acquired Kimono, a cloud data integration solution for the education market and rebranded the company as Elevate Data Sync. And in April of this year, it acquired stackable digital credentials developer, Concentric Sky.

- Feb 2021: LumApps added no-code onboarding and HR automation capabilities by acquiring HeyAxel.

- Feb 2021: People activation platform provider, Enboarder, raised $32 million in a Series B round, for a total of $50 million in funding to grow its people journey capabilities.

- Mar 2021: Trainer selection company, Electives, raised $8 million in Series A funding to expand its live learning support platform.

- Apr 2021: Mytaverse closed $7.6 million seed round for further development of its enterprise metaverse infrastructure.

Learning Tech Industry Investment: What’s Ahead?

There’s no doubt about it – learning systems have been on a wild ride. Even if you’ve only skimmed through these mergers, acquisitions and funding deals, I’m sure you’ll agree that this list is impressive by any measure.

Clearly, this flurry of deals didn’t happen by accident. It’s the result of multiple factors working in concert to unleash a perfect investment storm – a pandemic that forced the shift to online learning, an abundance of venture capital chasing scalable opportunities, and organizations around the world that have been looking for better ways to learn and work.

But all that glitters is not gold. Now, a more ominous storm is looming over the learning tech industry. Today, the combination of soaring inflation, rising interest rates and unstable supply chains threatens to cool business activity at large. And we should expect the learning tech industry to follow.

If you doubt this word of caution, consider the recent turn of events at Thinkific, a cloud-based platform for subject-matter experts. After its IPO in March 2021, Thinkific was flying high and doubling its headcount to support aggressive growth plans. But that ended abruptly this March, when the company laid off 20% of its workforce – 100 people – after a net loss of $26.4 million in 2021.

Of course, this is only one case. But it’s important to keep in mind that business buyers are becoming more cautious, and this is bound to have implications for the learning systems market.

The rollercoaster ride continues…

Thanks for reading!

Share This Post

Related Posts

Top LMS Selection Speed Bumps: Customer Ed Nugget 18

If you're a customer education leader, sooner or later you'll need to choose a learning system. How can you avoid LMS selection speed bumps? Find out in this Customer Ed Nuggets podcast

CEdMA Conference Takeaways: Customer Ed Nugget 17

What's top-of-mind among customer education professionals these days? Join Analyst John Leh and industry leader Kristine Kukich as they compare notes from the recent CEdMA Conference

The Future of Customer Education: Customer Ed Nugget 16

Customer education is rapidly evolving as organizations embrace new strategies and tech. What does this mean for the future of customer education? See what experts say on this Customer Ed Nuggets episode

Education Strategy Mistakes to Avoid: Customer Ed Nugget 15

What does it take to deliver a successful customer education program? It starts with a solid education strategy. Learn how to avoid common pitfalls on this Customer Ed Nuggets episode

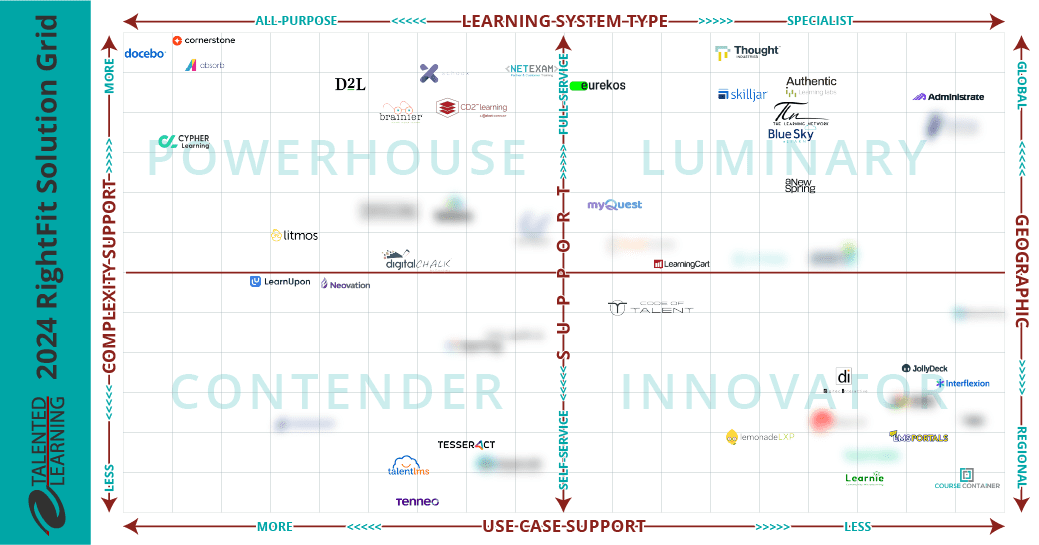

Which LMS is Best for You? New Shortlisting Tool for 2024

How can you find the best learning system for your business? Our LMS shortlisting tool can help. Learn about the 2024 RightFit Solution Grid. Free, reliable guidance based on our independent research

How to Build a Learning-Based Business: Executive Q&A Notes

Building and selling online courses may seem easy, but building a profitable learning-based business is far more complex. Find out what successful leaders say about running this kind of business

The Rewards of Community Building: Customer Ed Nugget 14

What role does community play in your customer relationships? Find out why community building is such a powerful force in customer education on this Customer Ed Nuggets episode

Benefits of Training Content Syndication: Customer Ed Nugget 13

If you educate customers online, why should you consider content syndication? Discover 10 compelling business benefits in this Customer Ed Nuggets episode

Top Marketing Skills to Master: Customer Ed Nugget 12

Successful customer education programs depend on professionals with expertise in multiple disciplines. Which marketing skills lead to the best results?

FOLLOW US ON SOCIAL