Docebo: Surprising Leader In Learning Management Platforms

The LMS market is often considered a red ocean: hundreds of vendors, highly complex user needs, and few vendors making a profit. Over the last decade almost every leading LMS vendor (Saba, Docent, Plateau, Learn.com, Litmos, Sumtotal) was acquired, largely because they couldn’t sustain their growth in a highly competitive market.

For LMS buyers this has been a challenge. Every company needs a system to track and manage training, and there are so many options it’s utterly confusing. And once you buy and implement such a system, it quickly becomes a “legacy system,” filled with content and highly interconnected to other learning tools. And since the variations in training programs are endless, there are always features you need that just aren’t there yet.

A decade ago, LMS systems morphed into talent platforms, so the market consolidated quickly. Cornerstone owns many of the biggest players and both Workday, SAP, and Oracle continue to deliver these systems. But as they grow they’re almost always hard to use (companies have thousands of courses and learning objects), so we usually put many other tools (LXPs and portals) in front of them.

Since that time many things have changed. We now have millions of videos and courses to curate and most employees want learning in the flow of work (on their phone). Microsoft Viva Learning, LinkedIn Learning Hub, and more than 40 other LMS’s have been launched in the last five years, so once again investors say to themselves “is this a good market to be a part of?”

Along comes Docebo, a vendor many buyers don’t know well, and a new leader emerges. I’m not saying Docebo has the largest market share, but this is a public company that’s worth $1.3 Billion, has 3,500+ enterprise customers, and is growing its annual recurring revenue by 55% per year. And their total invested cash is only $14 Million.

What have they figured out that other players missed?

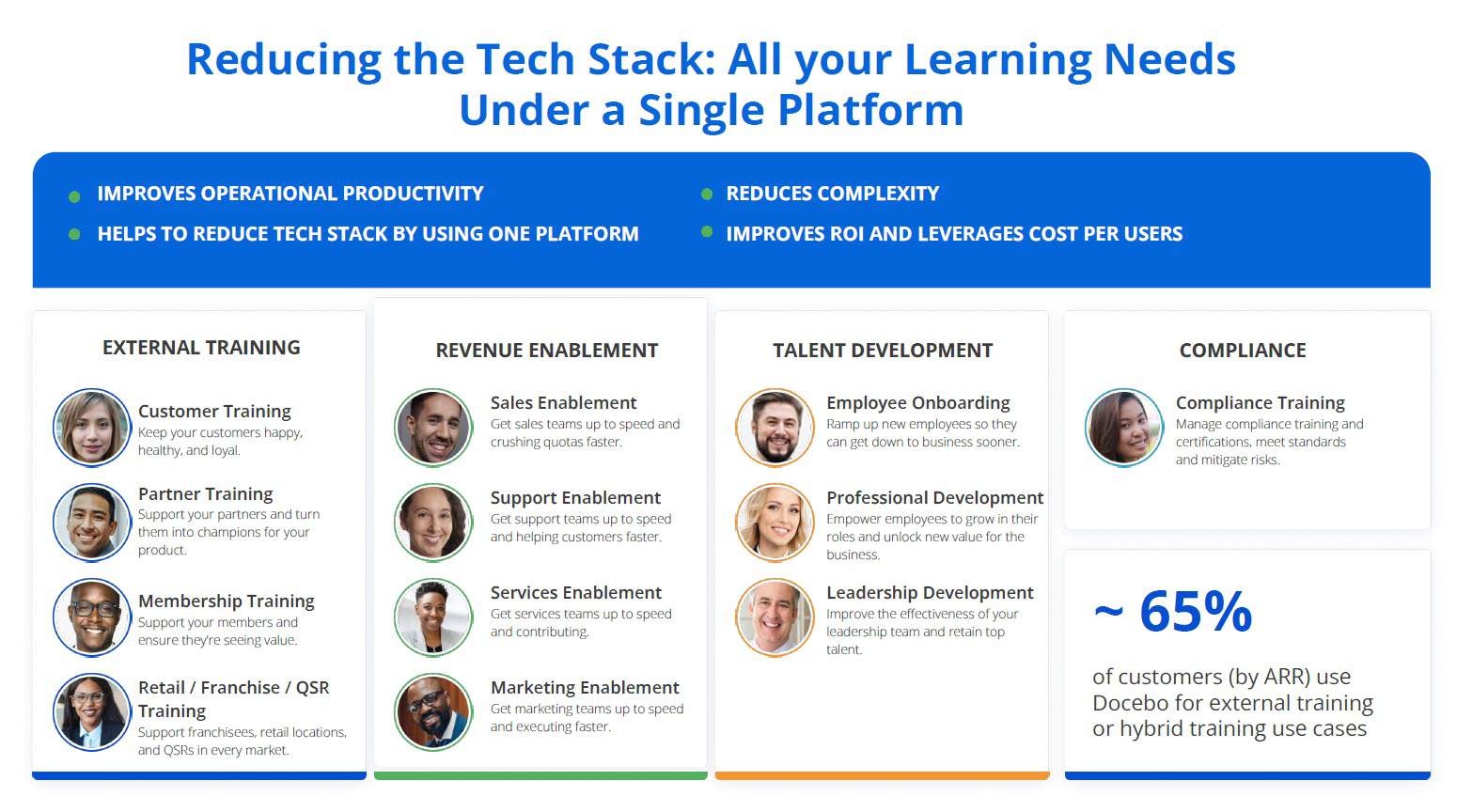

I think the answer is simple: Focus. Docebo figured out that corporate HR is not the only market for LMS platforms. Learning platforms are needed for sales training, channel training, specialized training for product teams, finance groups, support groups, associations, regulatory agencies, and consumer companies training their customers. And by focusing on these different buyer segments, Docebo has found a massive market. In fact almost two-thirds of Docebo’s revenue comes from buyers other than HR.

|

Let me give you a simple example. When we were looking for a platform for The Josh Bersin Academy, we ignored all the typical LMS players. None of them had the features, user-experience, cohort-based learning, and e-commerce we needed to grow. While we didn’t select Docebo, we found a platform that was nearly perfect – and our business is growing at more than 100% per year.

This is Docebo’s secret. While the product works well for corporate training applications, the company sells to every major line of business in an organization. Customers like Amazon (AWS), L’Oreal, Heineken, and many more generate revenue with Docebo, and that means they grow their revenue (and their Docebo fees) as their learning business grows. And let me assure you, this business of selling learning and training is massive. Think about every company that has a reseller channel, distributor network, affiliates, franchisees,or integration partner. All these companies need a platform to sell and deliver training, and the content and experience is very different from internal L&D.

The bigger LMS vendors call this “external enterprise training,” and that essentially defines their problem. These vendors build features for customer training use cases, but always as an after-thought. They are too busy investing in competency modelling tools, skills engines, and even performance management and development planning apps for HR. Companies don’t need any of that for customer and channel training: they need very different features. So Docebo gobbles up that business.

But there’s more. Since Docebo is a savvy sales and marketing company, they track client wins and feature sets by buyer. So there is a product roadmap and set of features for each of these segments. This enables Docebo to prioritize and meet the needs of these buyers quickly, giving them a sense of confidence that Docebo understands their needs.

As far as the core platform goes, I talked with Claudio Erba (founder) and Alessio Artuffo (president) about AI almost five years ago. They’ve been working on advanced algorithms for personalized learning, content recommendations, and content analytics for years. Now, as the company builds out its Shape product (and new engineering team from acquired Edugo.ai), Docebo plans to offer tools that generate learning content almost automatically, making it easier than ever for sales, channel, and other training managers to get materials out fast.

Competitors Aren’t Standing Still

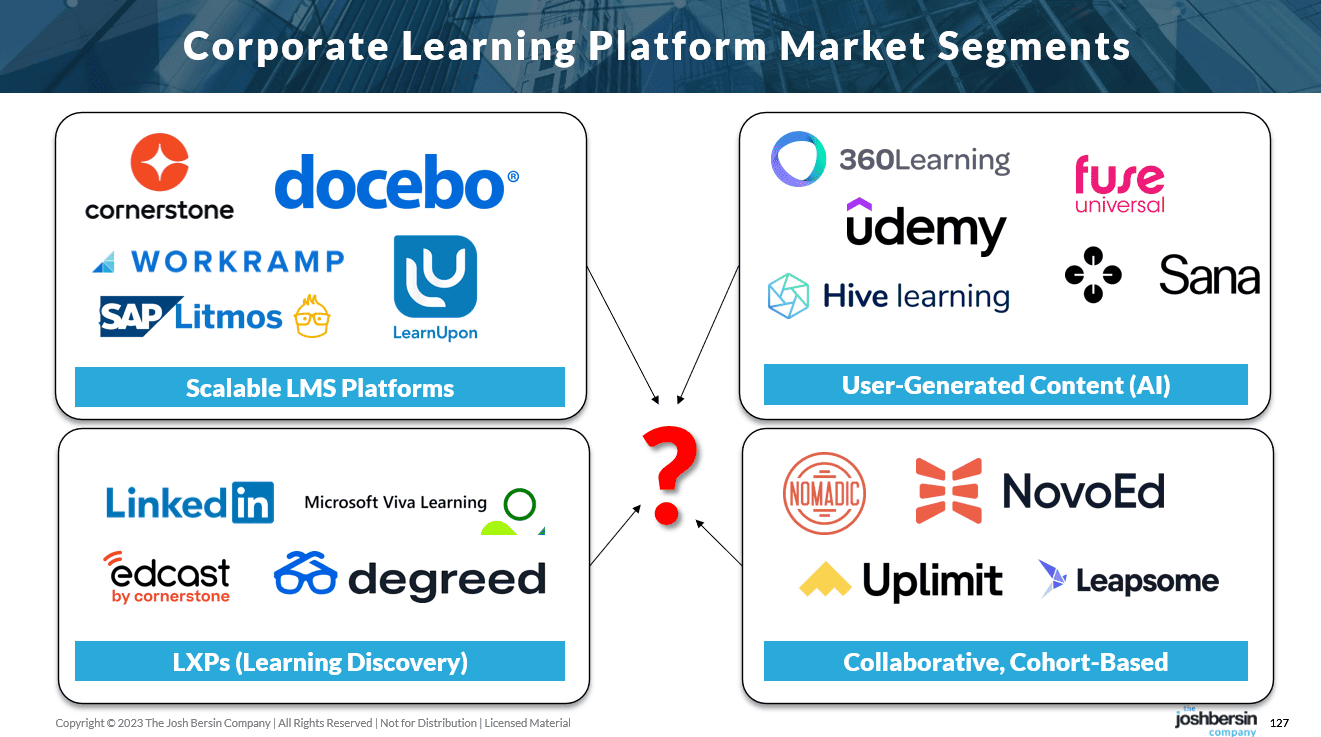

While Docebo is a well run company, their competition isn’t standing still. Hot new vendors like Workramp, Sana (AI-powered learning platform), 360 Learning, NovoEd, Uplimit, LMS365, Learnupon, Microsoft (Viva Learning), and others are working away on their products. And Cornerstone, the largest player by far, is stitching together its multiple LMS platforms (Saba, SumTotal, Cornerstone, EdCast) with an exciting AI-powered skills framework that brings new life to their offering.

Workday and SAP continue to advance their platforms, and their customers often use the learning system simply because it’s tightly integrated. But they don’t have the use-case focus of Docebo, and they just aren’t quite as passionate about this complex and crazy market. The LMS space is massively complex and AI is going to change it fast. (Consider the fact that YouTube is by far the biggest learning platform in the world.) So the ERP vendors have lots of things to work on.

And remember, there are many “sub-segments” to consider. The LMS is usually called the “system of record” for training, but there are also powerful tools for social learning, collaborative learning, learning discovery (LXP), and user-generated content. I actually believe self-authored content (people sharing what they’ve learned) is going to become one of the biggest parts of this market, and most of the vendors don’t have the tools or AI to address that opportunity.

|

I believe Docebo can teach many HR Tech vendors a lesson. If you stay focused on your market and make sure you’re clear on your buyer, you can build a company meets the needs of tens of thousands of customers. Docebo’s success has attracted Ceridian (resells Docebo as Ceridian Learn), Darwinbox (now distributes Docebo in India), and MHR (payroll provider who resells in the UK). These companies trust Docebo because they’re focused.

Let’s hope Docebo continues their laser focus, we all need learning solutions that hit the nail on the head.

Additional Information

A New Strategy For Corporate Learning: Growth In The Flow Of Work

The Creator Market for Corporate Learning: A Massive, Still Untapped Market

The Academy at Bank of America

The Learning Record Store: Demystifying This Important Technology

Operational Skills Management: An Essential Business Imperative