The $340 Billion Corporate Learning Industry Is Poised For Disruption

Companies spend more than $340 billion on employee training and development, averaging more than $1500 per employee per year. And this massive spend, which supports a global industry with hundreds of content and technology companies, is about to be reinvented at its core. Let me explain.

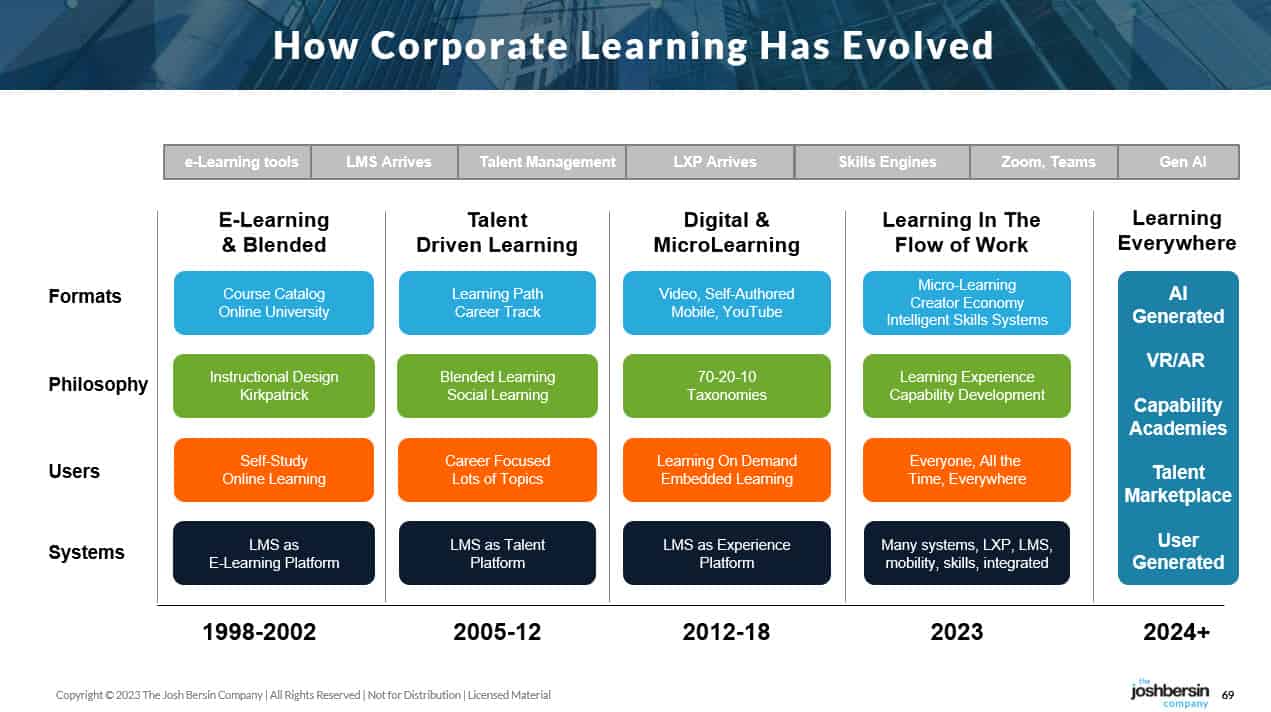

From E-Learning to We-Learning to Autonomous Learning

In the late 1990s the training industry, which was largely made up of classroom programs, was radically changed by the internet. Companies and content providers rushed to build “E-Learning” courses, trying to mimic the instructor led experience online. This innovative period, which today seems quaint, gave birth to companies like Skillsoft (which acquired dozens of its competitors), Cornerstone (which also acquired dozens of its competitors), and a wide variety of legacy LMS companies (Plateau, SumTotal, Learn.com, Pathlore, and many others), each of which were acquired over time.

The LMS market (Learning Management Systems) is now over $20 billion in size, and it was essentially created and formed by online training. And these systems, as clunky as they seem, are vital transaction and record-keeping systems for every company in the world.

|

As companies rushed to purchase LMS systems (it was a very hot market for investors), they realized that a large course catalog was not useful. So they built out a set of features for what I call “talent-driven learning,” including competency-based learning, courses aligned with job roles, and career path systems. These features, which were added to the LMS, made the system feel more like an “HR-system” than before, encouraging the vendors to expand into various talent management functions.

The early pioneers, Saba and Cornerstone, started to release performance management tools. While they now seem silly in retrospect, at the time this was a breakthrough. And suddenly companies decided that rather than buy a standalone LMS they would buy a “talent management suite,” forcing the focused LMS vendors to get into recruiting, goal management, and even compensation management. Little did they know that by abandoning their core they would eventually suffer the fate of disruption.

Along comes Facebook (2004, YouTube (2005), and Twitter (2006), and suddenly the world of content changed. Now people could find videos, articles, and experts online, and these clunky course-catalog oriented LMS systems felt very hard to use. So the LMS market, which had spent its wad on talent management, started to feel out of date as companies looked for help. The LXP (Learning Experience Platform) market (Pathgather 2010, Degreed 2012, EdCast 2013) came to life, and companies shifted their investment in this direction. (Read “From E-Learning to We-Learning for some history.)

The whole idea, during the early 2010s, was to mimic Google and create a corporate learning system that was as dynamic as Twitter and as content-rich as YouTube. The LMS or Talent Management systems became legacy applications, and those vendors, suffering slow growth, consolidated into only a few big players.

Next came microlearning. The i-Phone became a video platform (2008) and companies like Instagram (2010), Snapchat (2011), and later TikTok (2015) taught us that small videos and “microlearning” (or micro-entertainment) was fun. The two hour online courses felt too slow and too long, so the LXP vendors started to expand. And as companies threw more and more content into their LXPs, we realized we needed a way to find, pinpoint, and personalize all this stuff. (Watch “Learning in the Flow of Work” for more details.)

This, of course, unleashed the content market. Vendors like LinkedIn, Coursera, Udemy, OpenSesame, Go1, and others decided to capitalize on this space, fueling a frenzy in new material to consume. Since then the content market has continued to flourish, but is still mostly dominated by smaller players, consolidated by bigger aggregators who sell and distribute many brands.

(By the way, in 2016 Workday acquired Mediacore, a video company, in an effort to catch this wave. It was missing core LMS functionality so it took years to build it into a full fledged LMS).

Enter the world of skills. Believe it or not, the concept of a “skills system of record” started in the LXP space, where vendors like Degreed and EdCast built a database of search terms and used the word “skills” to tag content. In the consumer world we pick up hundreds of signals to recommend an advertisement, but the LXP vendors had only a few engineers so their “skills taxonomies” were quite simple. The idea caught fire and companies started to focus on building a “skills-based” training and later recruiting and talent strategy.

Meanwhile, of course, the L&D space was in creative chaos. Vendors like 360 Learning, Fuse Universal, Kineo, and hundreds of other content authoring and sharing systems appeared, all built with the goal of helping companies author video content, share it, and organize it by role, skill, or job function. These were not LMS systems, per-se, but they sat in front of the LMS, enabling employees to build and consume dynamic content easily.

This period of time, from 2018 until today, become a period of frenzy in L&D. Hundreds of video content tools flooded the market, while pioneers like STRIVR and Talespin started to build tools and content systems for VR. The self-authoring platforms, video platforms, and VR Platforms were all filling important needs, while the LMS market became more static, boring, and uninteresting. (Talespin was just acquired by Cornerstone.)

By the way, I continue to believe the market for “Capability Academy platforms” is enormous (integrated platforms for professional capabilities and cohort-based learning, like our Josh Bersin Academy). Vendors like Docebo, Learn-In, Nomadic, NovoEd, and Intrepid are still growing, but over time these systems may be integrated into talent marketplaces. This space has been a bright spot. (Read “The Capability Academy: Where L&D is Going” for more.)

As an analyst I actually found the last few years kind of dull, to be honest. We have helped hundreds of companies figure out what L&D systems to buy, but in most cases we found organizations with too many platforms, a mess of content all over the place, a lack of consistent data, and exorbitant over-spending in the domain. So this static period, which characterizes the last 3-5 years, was a good time for companies to “clean up” all their purchases in the last decade.

Suddenly the world changed again. Not only did the skills taxonomy idea become a wildfire, but talent intelligence systems like Eightfold, Gloat, Fuel50, and many others came to market. These new systems, which enabled companies to find people by skill, recommend jobs and opportunities by skill, and dynamically identify career paths by skill, again collided with the L&D market, encouraging us to take all our content and “integrate” with these new platforms. (Read “The Talent Intelligence Primer” for more.)

I just got off the phone this week with one of my favorite L&D gurus (who is coming to speak at our conference) and he showed me how his big pharma company is evolving its LMS, LXP, and Talent Marketplace into a seamless, end-to-end architecture. He is a bit ahead of the curve, but this is where things are going.

But the story continues, so let me move to the present. Another disruption has arrived, and this one is as big (or bigger) than YouTube, Instagram, or the i-Phone. Yes, it’s AI.

AI, as many of you can imagine, is about to flip this industry on its head. And as we witnessed in the e-learning and talent management days, it means the vendor landscape will totally change.

Why AI Changes Everything

Without being too histrionic, let me give you the story. Throughout this 30 year story, one thing remains the same. Corporate training is all about content. Yes, we may want it smaller, faster, and on our phones – but if the content itself is not useful, practical, and easy to consume, it simply will not work. How many of you have clicked through the page-oriented compliance courses to get credit but barely paid attention? Well that’s ultimately the challenge. And all these gyrations toward video, micro-learning, MOOCs, and everything else are all attempts at solving this problem.

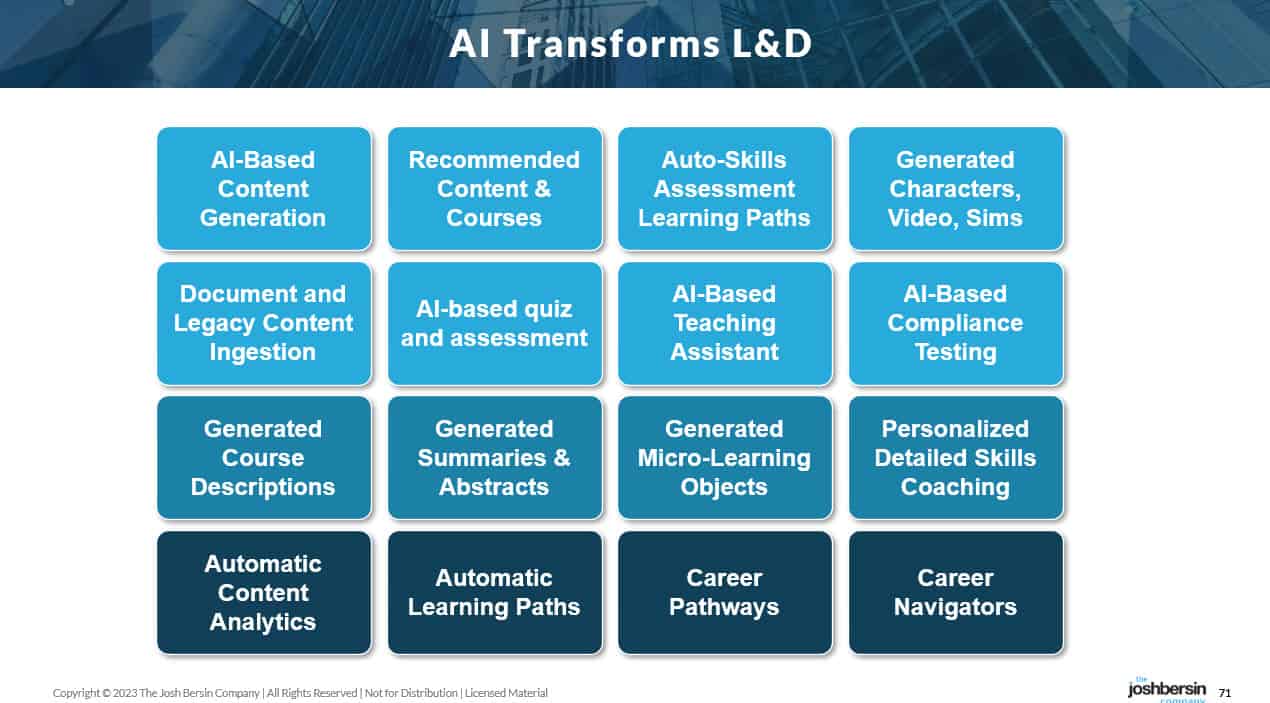

What if, for example, the corporate learning system knew who you were and you could simply ask it a question and it would generate an answer, a series of resources, and a dynamic set of learning objects for you to consume? In some cases you’ll take the answer and run. In other cases you’ll pour through the content. And in other cases you’ll browse through the course and take the time to learn what you need.

And suppose all this happened in a totally personalized way. So you didn’t see a “standard course” but a special course based on your level of existing knowledge?

This is what AI is going to bring us. And yes, it’s already happening today.

|

Not only can generative AI answer questions and injest content (Galileo™ now houses every piece of research we’ve done for 25+ years, including videos and podcasts and articles), it can generate videos, tests, quizzes, and even courses. It can serve as a teaching assistant for a technical course and as a coach or mentor for a leadership program, and it can translate into any language.

And AI can look at who you are and dynamically generate content based on your needs.

What happens to the LMS market, the LXP market, the VR learning market, and all the content providers? We’re going to have a massive shakeout in the years ahead.

What Vendors Are Doing

While I don’t know what every L&D vendor is doing, I can assure you that things are happening fast.

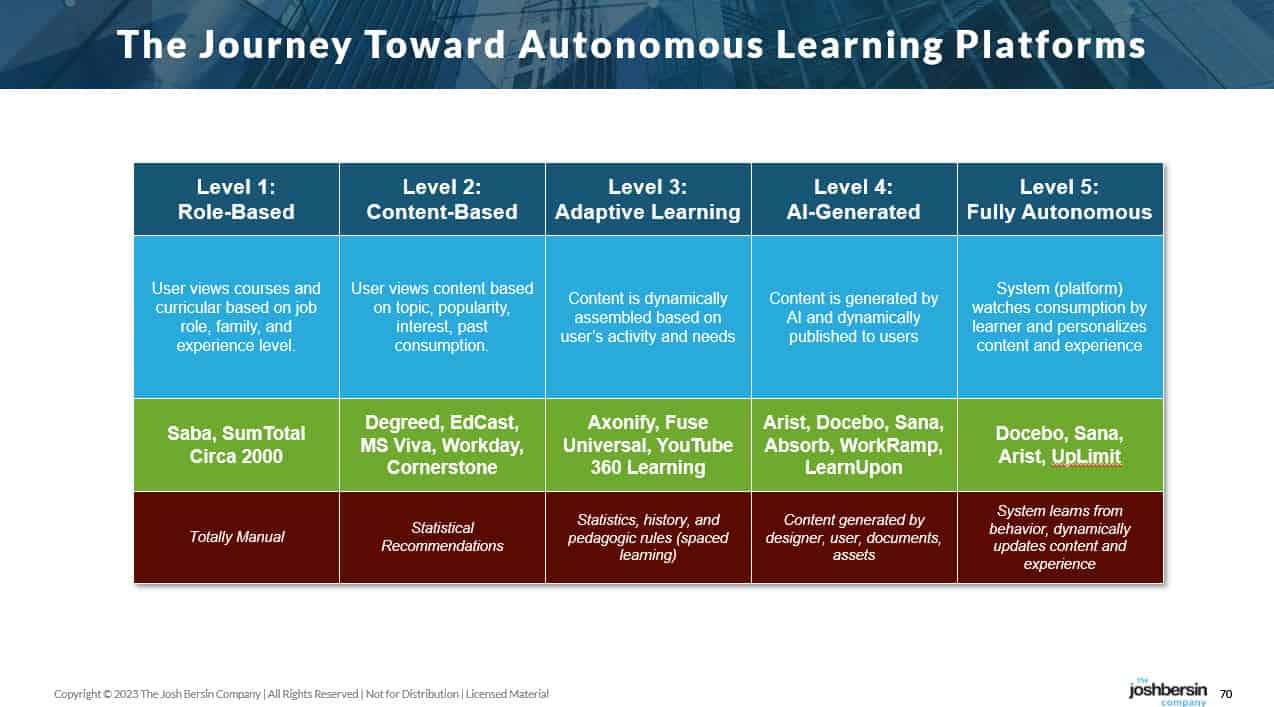

Docebo Shape can generate high-powered interactive training from documentation (as can Arist). Uplimit has built a whole L&D platform with AI based agents and self-generated content during courses. Sana (our partner with Galileo) can not only auto-generate content but they’ve built an entire LMS around an AI core. Cornerstone, through their acquisition of Talespin, can dynamically build character simulations and almost infinitely-configurable scenarios. And Growthspace, a fast-growing “precision skilling” vendor, can assign you a “skills-coach” based on 1100 specific business skills, aligned with your specific goals.

|

The LMS market is not going away, but just as talent intelligence is eating away at ATS and HRMS systems, AI-driven content platforms will eat away at the LMS. My friend at the Pharma company wants his LXP to become their “dynamic content system,” but frankly I don’t know if the LXP vendors are up for it. Many vendors, from LinkedIn to Microsoft and more, are going to have to figure out how they become “dynamic learning” systems, and what role they want to play.

As with all technology shifts, the new “built from the ground up” systems typically outperform the incumbents. If you’re Cornerstone or Docebo, and you have thousands of customers, you can’t just “replace” what you’ve built when new technology emerges. So it’s likely the AI-driven learning systems will come from new vendors, and these guys, as they grow, will start to replace and compete with what you have.

Despite its appearance, learning technology is dauntingly complex. It has taken Workday almost ten years to go from Mediacore to a fairly robust LMS, and they are just starting to embrace AI. So don’t expect (or demand) your incumbent vendors to do backflips overnight.

But I’ll tell you one thing for sure: disruption is coming. Just as Plateau, Saba, and SumTotal were “the hottest vendors in the market” in the early 2000s, they quickly became legacy systems and acquisition candidates when the market changed. The same impact could happen today, and newer vendors like Sana, Growthspace, Uplimit, Docebo, LMS365, and others will emerge.

The VCs tend to be afraid of this market, so often the “winners” are the companies with the best management teams. Large vendors like LTG, Cornerstone, and Skillsoft have deep pockets, so as the market evolves anything could happen. But one thing is clear to me: there is a massive growth cycle ahead.

The AI Opportunity Is Real, And Simply Massive

Think about the volume of legacy content in our companies. There must be more than a $Trillion of compliance, sales training, operations training, safety training, and leadership development content in the world. If AI can “repurpose” and “regenerate” this content at scale, we will see this massive market shift to new systems, bringing knowledge management and learning together at last.

Let me leave you with a simple example. One of our Galileo clients is a large aerospace company with 100+ years of engineering, product design, aerospace, and defense technology at work. They have built jet engines, missiles, nuclear subs, and all sorts of bombs and systems over time. It takes them 3+ years to “onboard” a new engineer, given the huge amount of intellectual property, design expertise, and systems at work. And their senior engineers are all retiring!

They are embarking on an AI-centric pilot (with our help) to take years of content and put it into a new platform for young engineers. And I believe the results will be earth-shattering. Galileo will help with management issues, and a similar AI assistant will help engineers learn, find documentation, watch videos, and take relevant courses. The existing LMS and HRMS tools probably won’t play a role.

Think about your company. How much content, expertise, and legacy training are you sitting on? AI can “unleash” this to your workforce and make it available like never before. It’s a bold new world ahead, with lots of exciting changes to come.

PS: If you join us at Irresistible this year, we’ll show you how this works. We’re planning on having many of our Galileo clients talk about their experiences and we can demonstrate how AI enables dynamic content generation, knowledge management, and an amazing user experience to revitalize how people learn.

Additional Information

Autonomous Corporate Learning Platforms: Arriving Now, Powered by AI

Cornerstone Acquires Talespin: AI Meets Metaverse In Corporate Learning

Interview With Joel Hellermark, CEO of Sana – AI-Powered Learning Arrives

Virtual Reality Has Now Gone Mainstream For Corporate Training