5 Steps to Assess Business Financial Health

Coreaxis

JUNE 28, 2023

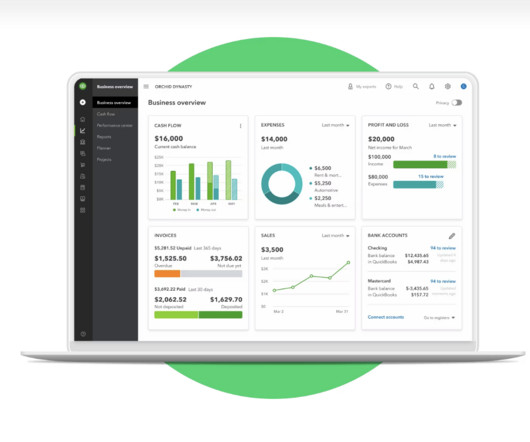

It outlines the company’s assets, liabilities, and shareholders’ equity. Liabilities, on the other hand, represent the company’s debts and obligations, such as loans, accounts payable, and accrued expenses. Lastly, the cash flow statement tracks the inflow and outflow of cash within the business.

Let's personalize your content