5 Steps to Assess Business Financial Health

Coreaxis

JUNE 28, 2023

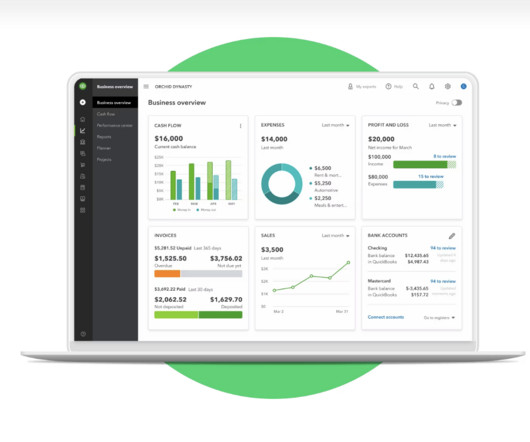

Understanding the Components of Business Financial Health Before diving into the analysis, it is essential to understand the fundamental components that comprise a company’s financial health. It outlines the company’s assets, liabilities, and shareholders’ equity.

Let's personalize your content